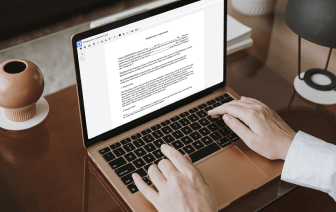

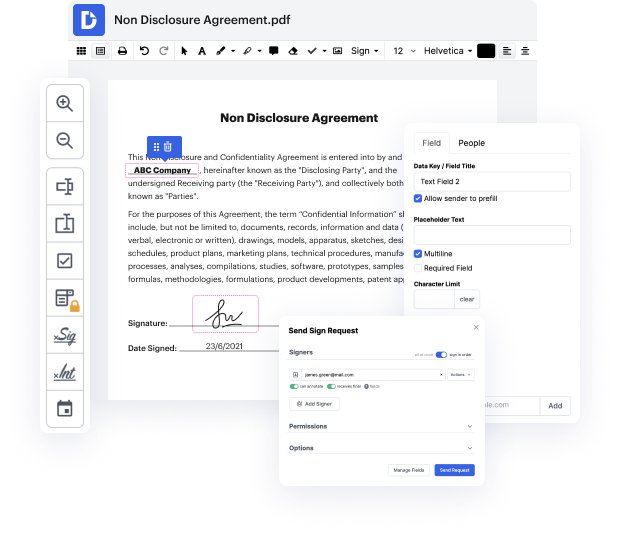

Do you want to avoid the difficulties of editing Form W-4 on the web? You don’t have to bother about installing untrustworthy solutions or compromising your documents ever again. With DocHub, you can copy data in Form W-4 without spending hours on it. And that’s not all; our user-friendly platform also offers you powerful data collection tools for collecting signatures, information, and payments through fillable forms. You can build teams using our collaboration capabilities and efficiently work together with multiple people on documents. On top of that, DocHub keeps your information secure and in compliance with industry-leading protection requirements.

DocHub enables you to access its tools regardless of your device. You can use it from your notebook, mobile phone, or tablet and edit Form W-4 easily. Begin working smarter right now with DocHub!

in this video were going to fill out the IRS form W4 as married filing jointly now Im going to go through three separate calculations and then the final calculation is going to be the IRS form W4 the online estimator which is by far the best way of doing it but I want to run through these calculations just so you can see the differences on how each calculation will affect your paycheck so the first way that were going to use is just filling out this paper version now whether or not you have the paper version or you have to use your employers online portal it doesnt matter because youre going to use the same answers whether or not its just in the paper version that youre submitting to your employer or if youre taking this information and putting it into the portal so the first way that were going to do it is going through just this paper version right here and were literally going to just fill out the top sign it and give it to our employer now Im going to run through an exa