Are you looking for a straightforward way to copy arrow in VAT Invoice Template? DocHub offers the best solution for streamlining document editing, signing and distribution and form completion. With this all-in-one online program, you don't need to download and install third-party software or use complex document conversions. Simply add your document to DocHub and start editing it in no time.

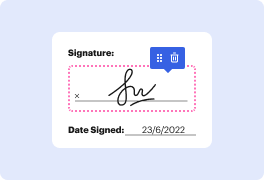

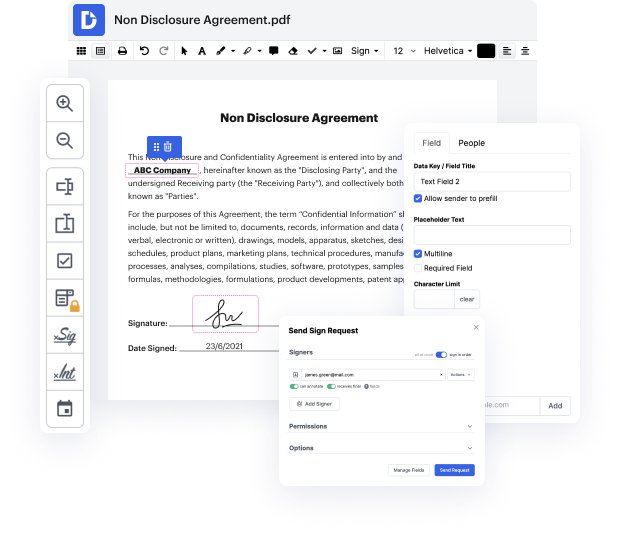

DocHub's drag and drop user interface allows you to easily and effortlessly make tweaks, from intuitive edits like adding text, pictures, or visuals to rewriting whole document components. Additionally, you can endorse, annotate, and redact papers in a few steps. The editor also allows you to store your VAT Invoice Template for later use or transform it into an editable template.

DocHub offers beyond you’d expect from a PDF editing program. It’s an all-encompassing program for digital document management. You can utilize it for all your papers and keep them secure and easily accessible within the cloud.