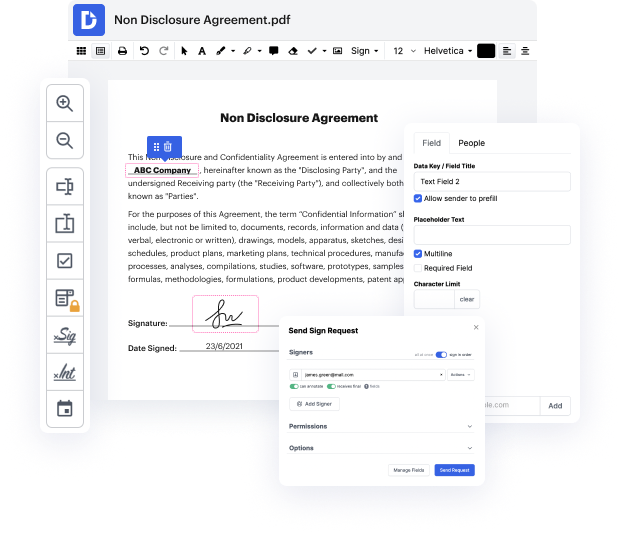

You know you are using the right file editor when such a simple job as Complete currency contract does not take more time than it should. Editing documents is now an integral part of many working processes in various professional fields, which explains why convenience and straightforwardness are crucial for editing resources. If you find yourself researching guides or looking for tips on how to Complete currency contract, you might want to find a more easy-to-use solution to save your time on theoretical learning. And here is where DocHub shines. No training is required. Just open the editor, which will guide you through its principal functions and features.

A workflow gets smoother with DocHub. Use this instrument to complete the files you need in short time and get your efficiency one stage further!

welcome to currency forward contracts currency forward contract is an agreement between two parties to exchange a fixed amount of one currency for another at an agreed-upon future date the exchange rate for the future transactions is fixed in advance at the time of signing the agreement the currency forward contracts can be either outright forwards or non-deliverable forwards and now try forward contract calls for future transaction where the two currencies are actually exchanged a non deliverable forward contract or NDF is settled in a single currency such as the US dollar both types of forward contracts can be used for speculation or risk management this tutorial discusses outright forward contracts lets consider a US technology company that just delivered an order to a UK customer and is expecting a payment of 10 million British pounds in 90 days lets assume that the current spot rate is dollar 60 per pound so in 90 days the exporter would expect to get 16 million u.s. dollars at

At DocHub, your data security is our priority. We follow HIPAA, SOC2, GDPR, and other standards, so you can work on your documents with confidence.

Learn more