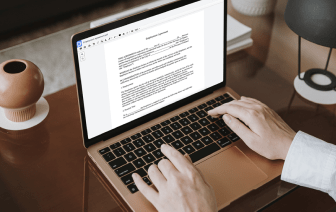

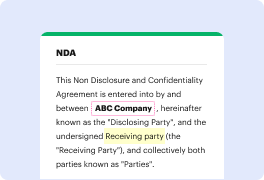

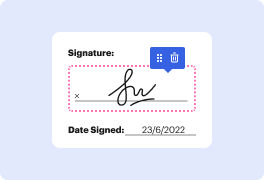

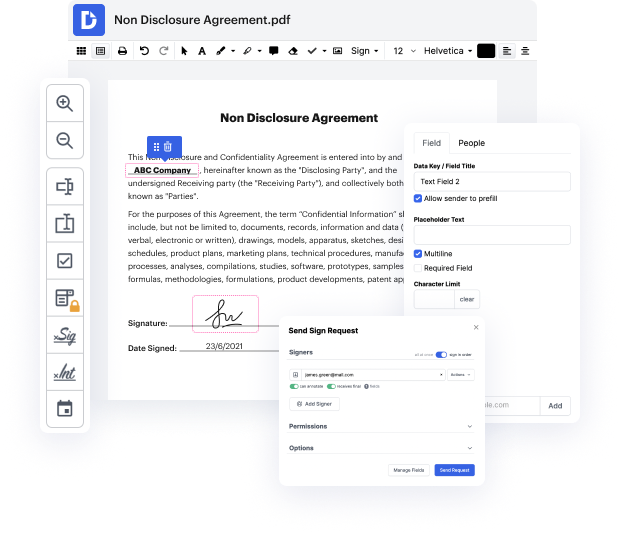

You no longer have to worry about how to clear up margin in QUOX. Our comprehensive solution provides easy and fast document management, allowing you to work on QUOX documents in a few moments instead of hours or days. Our platform contains all the tools you need: merging, adding fillable fields, signing documents legally, adding shapes, and much more. You don't need to install additional software or bother with pricey applications demanding a powerful computer. With only two clicks in your browser, you can access everything you need.

Start now and handle all various types of forms like a pro!

(bright music) - [Instructor] Margin, technically, is the difference between the market value of the stock owned and the loan amount. Different securities have different margin requirements. So if the margin requirement for buying stock XYZ is 30%, hereamp;#39;s how you would calculate the margin required to buy 1000 shares of stock XYZ, if itamp;#39;s priced at $50 per share. You take 1000 shares and multiply by $50 per share, multiplied by the margin requirement of 30%, which equals $15,000. So while your account will have $50,000 worth of stock XYZ in it, the minimum amount of cash you had to put up for this purchase was $15,000. You are allowed to borrow the other 70% or $35,000 from the brokerage. If the value of the stock decreases, you might run into the risk of a margin call. The maintenance margin requirement tells you how much margin you need to have at a minimum at all times. If the maintenance margin requirement is 25%, then if stock XYZ falls in price from $50 to $40, th