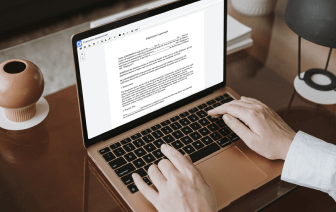

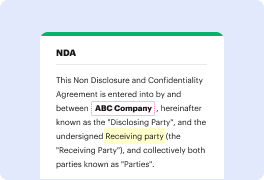

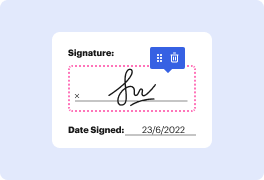

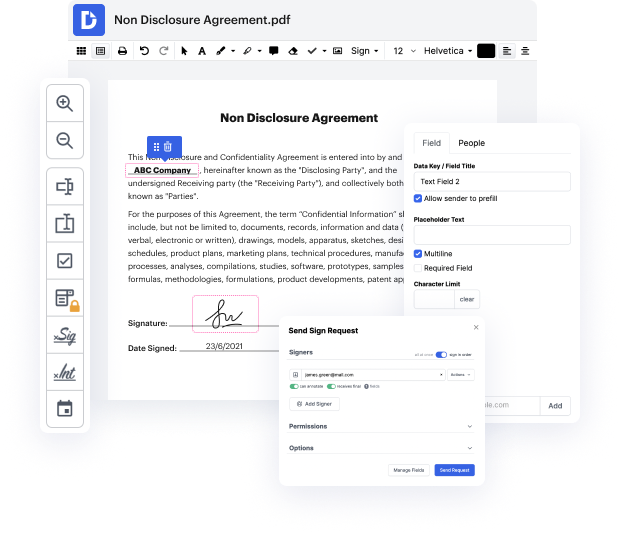

With DocHub, you can easily clear up ein in UOF from anywhere. Enjoy capabilities like drag and drop fields, editable text, images, and comments. You can collect electronic signatures safely, add an additional level of protection with an Encrypted Folder, and work together with teammates in real-time through your DocHub account. Make changes to your UOF files online without downloading, scanning, printing or mailing anything.

You can find your edited record in the Documents tab of your account. Edit, email, print, or convert your file into a reusable template. Considering the variety of robust tools, it’s easy to enjoy seamless document editing and managing with DocHub.

so in order to get access to your ein number youamp;#39;re going to go to irs.gov youamp;#39;re going to click on file business and self self-employed youamp;#39;re going to select this first employer id number and youamp;#39;re going to go um to lost or misplaced your ein however if you donamp;#39;t have one or need to apply to one thereamp;#39;s a few different options that you can actually select here but for now weamp;#39;re going to go to lost or misplaced your ein and itamp;#39;s going to take you to the page um with varies of different options to get access to your ein itamp;#39;ll first ask for you to find the computer generate a notice that was issued by the irs when you applied for your ein or another option is if you use your ein to open up a bank account or apply for any type of state or local license you should probably contact the bank or agency to secure your ein or if you filed previously um tax returns for your existing entity um for which you have lost or mis