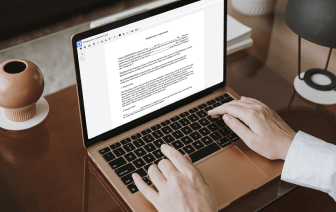

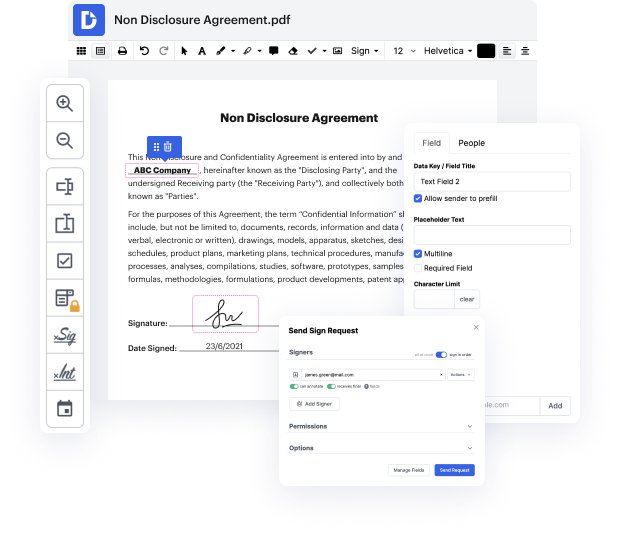

DocHub makes it fast and straightforward to clean up FATCA in xht. No need to instal any software – simply add your xht to your account, use the easy drag-and-drop editor, and quickly make edits. You can even work on your desktop or mobile device to adjust your document online from anywhere. That's not all; DocHub is more than just an editor. It's an all-in-one document management solution with form creating, eSignature features, and the ability to enable others fill in and sign documents.

Each file you upload you can find in your Documents folder. Create folders and organize records for easier search and access. Additionally, DocHub ensures the protection of all its users' data by complying with strict protection protocols.

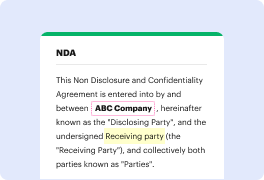

this is marine accounts we offer tax advice and mortgage solutions to yacht crew we believe strongly in providing free advice that can be used to help your crew make the right decisions with regards to their tax this lecture acts part of a series of talks under the topic of keeping your money yours this lecture will focus on what to do when you receive the letter from your bank which is regarding your tax residency the letter is to do with factor and CRS I will not bore you too much about these but I can tell you they both they both will affect you and itamp;#39;s something that you need to deal with the the letter itself has shown now artists you to provide your address and also a tax identification number or national insurance number the letter has come around because of CRS and factor and is used by the g20 to monitor where clients or resident they want to be able to verify that youamp;#39;re not withholding funds and that your country of residence is aware that you have these fun