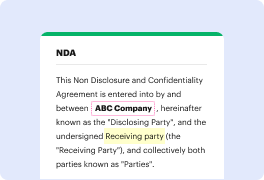

DocHub offers a smooth and user-friendly solution to change clause in your Plan of Dissolution. No matter the characteristics and format of your form, DocHub has everything you need to make sure a simple and trouble-free modifying experience. Unlike similar tools, DocHub stands out for its outstanding robustness and user-friendliness.

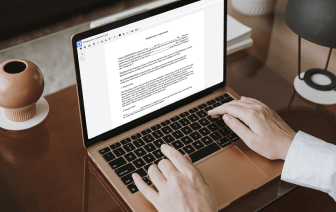

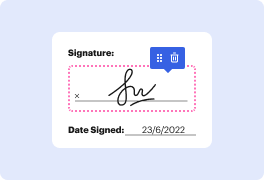

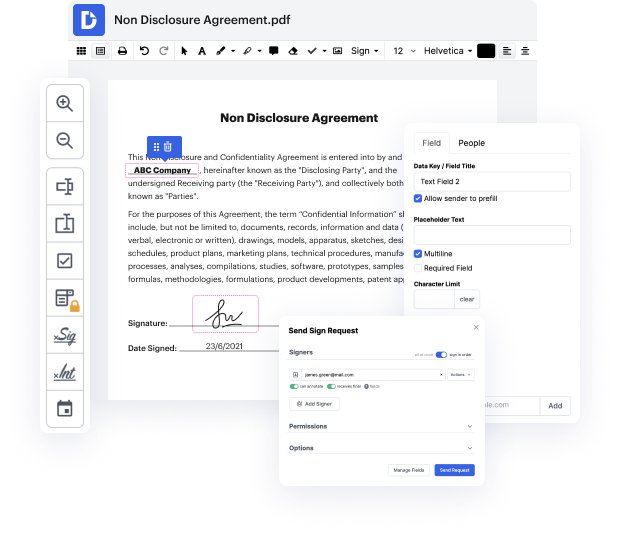

DocHub is a web-centered tool enabling you to change your Plan of Dissolution from the convenience of your browser without needing software installations. Owing to its easy drag and drop editor, the option to change clause in your Plan of Dissolution is fast and straightforward. With rich integration capabilities, DocHub enables you to transfer, export, and modify documents from your preferred platform. Your completed form will be saved in the cloud so you can access it readily and keep it secure. Additionally, you can download it to your hard drive or share it with others with a few clicks. Alternatively, you can turn your document into a template that stops you from repeating the same edits, such as the ability to change clause in your Plan of Dissolution.

Your edited form will be available in the MY DOCS folder in your DocHub account. On top of that, you can utilize our editor panel on the right to combine, divide, and convert documents and reorganize pages within your forms.

DocHub simplifies your form workflow by offering an incorporated solution!

hey there youtube so in this video i wanted to cover the irs form 966 this is the form for corporate dissolutions or liquidations so if you have a us corporation so this is a lets say a regular corporation for-profit corporation informed under state law or if you have an llc that filed an election to be taxed as a c-corp if you close down that entity you will need to file this form 966 within 30 days after you adopt a plan or resolution to close down the company so i want to run through the form the various elements and the things you need to include with it just to make sure youre doing this as correctly as possible so the top of the form is relatively straightforward right we have the name of the corporation uh here obviously ive got a company delaware company inc not a real business so dont use this uh the mailing address for the company the ein for the company and the type of return were filing right so this is a standard c corp return so 1120 if you have an s corporation th