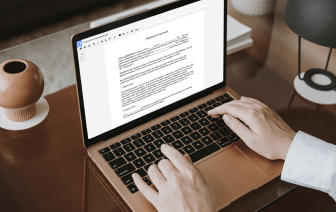

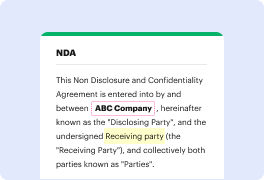

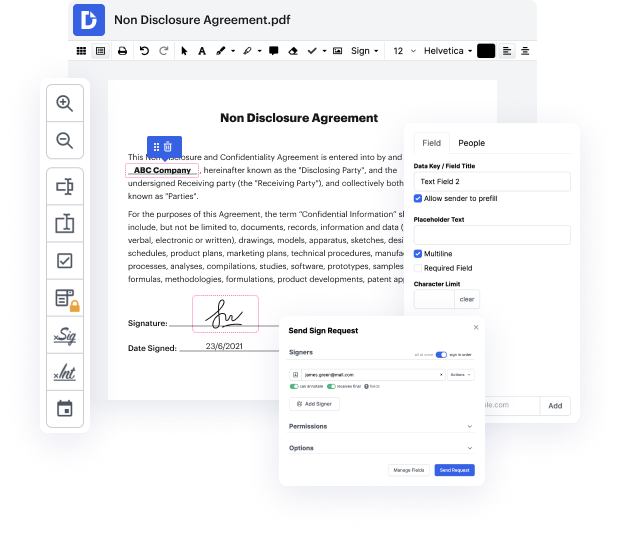

DocHub enables you to change caption in Form W-4 swiftly and quickly. No matter if your document is PDF or any other format, you can easily modify it leveraging DocHub's intuitive interface and robust editing features. With online editing, you can change your Form W-4 without downloading or setting up any software.

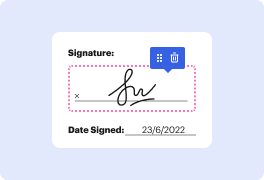

DocHub's drag and drop editor makes customizing your Form W-4 straightforward and streamlined. We safely store all your edited papers in the cloud, letting you access them from anywhere, anytime. Additionally, it's straightforward to share your papers with people who need to go over them or add an eSignature. And our deep integrations with Google products allow you to transfer, export and modify and endorse papers right from Google applications, all within a single, user-friendly program. Additionally, you can easily convert your edited Form W-4 into a template for repetitive use.

All executed papers are safely stored in your DocHub account, are effortlessly managed and shifted to other folders.

DocHub simplifies the process of completing document workflows from the outset!

so youre finally getting around to filing your taxes and you get smacked with a surprise bill from the IRS that money you thought you would save for a summer vacation gone to help with some guidance on managing your tax withholdings so you have no more surprises next tax season is our very own Rebecca Chen set us up for the 2025 filing season that looks back at 2024 Rebecca so tax tax withholding is something that I think everybodys fairly familiar with but I I do want to go back and touch on the basic on what exactly it is so you can get it right in the future or there are no surprise bills as you just mentioned BR for the future really um how would CPA explain this to me is that tax withholding is a prepayment that you pay to the government for your taxes throughout the year so every period out of your paycheck you pay a little bit of tax withholdings to the government and at the end of the year your W2 Tellies that up and it tells you how much you have in your withholding or how m