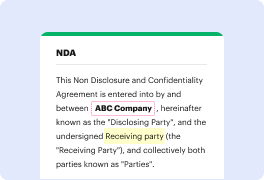

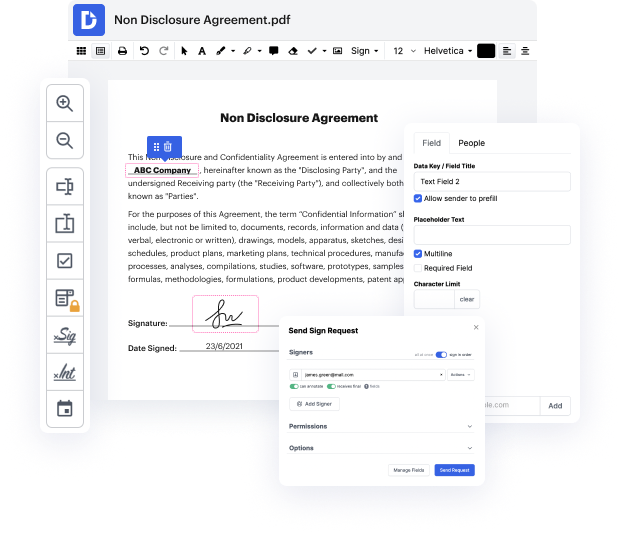

Contrary to popular belief, editing files online can be trouble-free. Sure, some file formats might appear too challenging with which to work. But if you have the right solution, like DocHub, it's easy to tweak any file with minimum resources. DocHub is your go-to solution for tasks as simple as the option to Certify Quantity Notice For Free a single document or something as intimidating as handling a huge stack of complex paperwork.

When it comes to a tool for online file editing, there are many solutions available. However, not all of them are powerful enough to accommodate the needs of people requiring minimum editing capabilities or small businesses that look for more advanced tools that allow them to collaborate within their document-based workflow. DocHub is a multi-purpose service that makes managing documents online more simplified and smoother. Sign up for DocHub now!

The EDD retroactive certification process is discussed in the video, addressing concerns about potential scams and the legitimacy of the certification. Viewers are encouraged to apply for certification promptly and to verify the process through the official EDD website if they have doubts. Questions can be asked in the comment section for assistance. Thank you for watching and sharing the video.

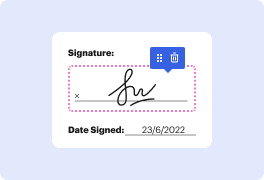

At DocHub, your data security is our priority. We follow HIPAA, SOC2, GDPR, and other standards, so you can work on your documents with confidence.

Learn more