What happens if you don't cancel your EIN?

Your EIN is yours forever, just like your Social Security number. Even if you're no longer in business and never used your EIN to file a federal return, that doesn't change anything. The EIN belongs to you. If you revive your business later, you can resume using your EIN.

How do I cancel or close an EIN number?

To cancel your EIN and close your IRS business account, you need to send us a letter that includes: The complete legal name of the business. The business EIN. The business address. The reason you wish to close the account.

Do I need to cancel my EIN if I close my business?

The EIN will still belong to the business entity and can be used at a later date, should the need arise. If you receive an EIN but later determine you do not need the number (the new business never started up, for example), the IRS can close your business account.

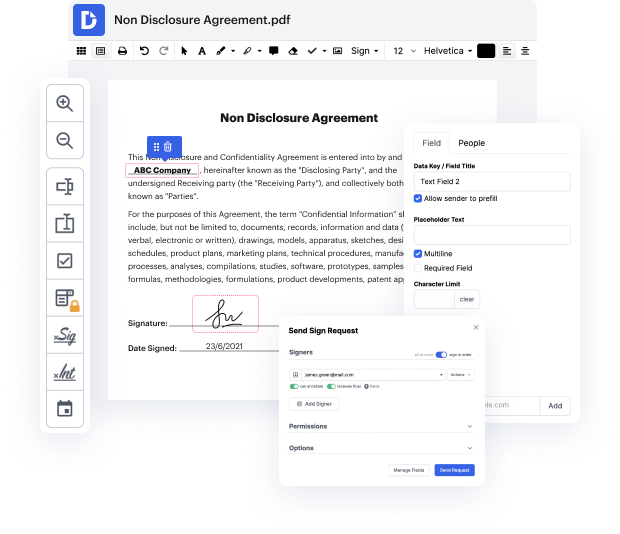

Can I cancel my EIN online?

The only way to send your Cancel EIN Letter to the IRS is by mail. Note: If you have your original EIN Confirmation Letter, please make a copy and include with the letter. Confirmation of EIN cancellation: The IRS will send a letter confirming their receipt of the updated information within 45 days or less.

How do I know if my EIN is active?

Call the IRS. The best number to call is (+1) 800-829-4933. ... You can call during IRS Business hours: 7:00 a.m. - 7:00 p.m. Eastern Standard Time (GMT-5). The shortest wait times are typically from 3:00 p.m. - 7:00 p.m ET. ... Depending on your phone service and where you are located, there may be fees when calling the IRS.

What happens if I don't use my EIN number?

More In File The EIN will still belong to the business entity and can be used at a later date, should the need arise. If you receive an EIN but later determine you do not need the number (the new business never started up, for example), the IRS can close your business account.

What happens if you don't cancel your EIN?

Your EIN is yours forever, just like your Social Security number. Even if you're no longer in business and never used your EIN to file a federal return, that doesn't change anything. The EIN belongs to you. If you revive your business later, you can resume using your EIN.

Can you cancel an EIN number online?

You cannot cancel your EIN, however, you can close your account with the IRS. You'll need to send a letter to the IRS office and explain the reason you want to close your tax account. You'll need to include important details about your business, such as the corporation name, structure, address and EIN.

What happens if I never use my EIN number?

Regardless of whether or not an EIN was ever used, the number is PERMANENT. The IRS cannot cancel EIN numbers; however, the business account associated with the EIN may be closed. If the EIN is needed in the future, it will still belong to the business entity even after the account is closed.

How do I write a letter to the IRS to cancel my EIN?

How do you write a letter to cancel an EIN? The letter must state the reason for closing the account and include the federal identification number, the complete legal name of the entity, and the business address. If a copy of the EIN Assignment Notice is available, be sure to include it with your letter.