Are you searching for an easy way to cancel ein in Form W-8BEN? DocHub offers the best solution for streamlining document editing, certifying and distribution and document execution. Using this all-in-one online platform, you don't need to download and install third-party software or use multi-level document conversions. Simply import your document to DocHub and start editing it with swift ease.

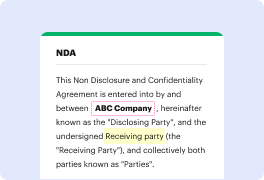

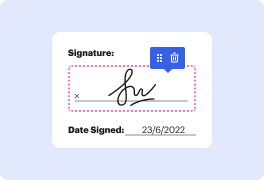

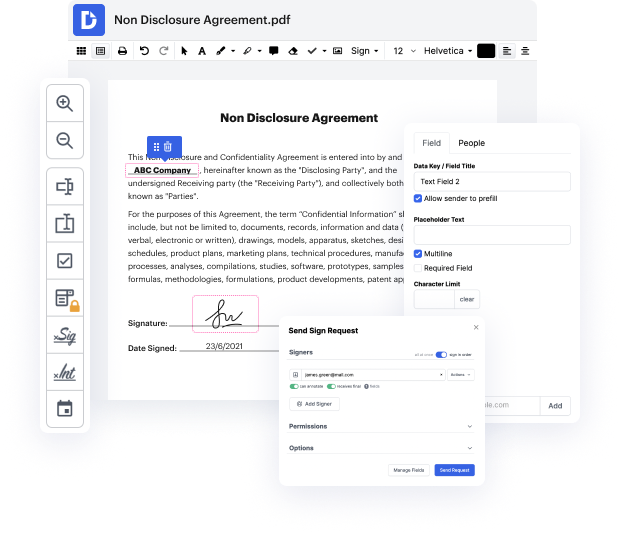

DocHub's drag and drop user interface allows you to swiftly and quickly make changes, from intuitive edits like adding text, pictures, or visuals to rewriting entire document pieces. Additionally, you can endorse, annotate, and redact papers in a few steps. The solution also allows you to store your Form W-8BEN for later use or transform it into an editable template.

DocHub provides beyond you’d expect from a PDF editing program. It’s an all-encompassing platform for digital document management. You can utilize it for all your papers and keep them safe and swiftly accessible within the cloud.