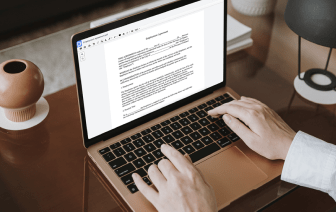

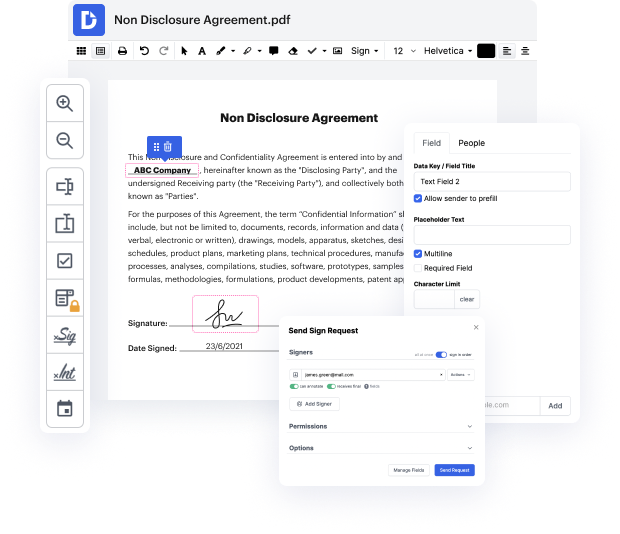

Do you need a simple and fast method to bold style in 1099-MISC Form? Look no further - DocHub gets the job done fast, with no complicated application. You can use it on your mobile phone and computer, or internet browser to modify 1099-MISC Form anytime and anywhere. Our versatile toolset includes everything from basic and advanced editing to annotating and includes safety measures for individuals and small companies. We also provide tutorials and guides that help you get your business up and running straight away. Working with DocHub is as easy as this.

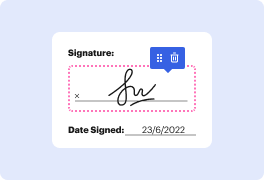

Simple, right? Even better, you don't need to worry about information security. DocHub offers quite a number of features that help you keep your sensitive data secure – encrypted folders, two-factor authorization, and more. Take advantage of the bliss of reaching your document management objectives with our reliable and industry-compliant solution, and kiss inefficiency goodbye. Give DocHub a try today!

hey guys and welcome out into todays video where were gonna be filling out an example very simply of a form 1099 miscellaneous if you hired out contract work for your business some non employee compensation so what youre going to want to do you have to order these forms from the IRS Ill link that down in the video description theyre gonna send you this booklet here for instructions on how to fill out the 1099 miscellaneous and then theyre also going to send you these things they I feel like newspaper but theyre gonna be stacked on top of each other so when you fill them out the ink bleeds to the other side and you can fill out a bunch of forms at the same time because of that so thats why you need to order these particular forms because theyre quite a bit different than just traditional computer paper that youd print them out on but for todays example were just gonna fill it out on this piece of computer paper that Ive printed out here so the first thing youre gonna want