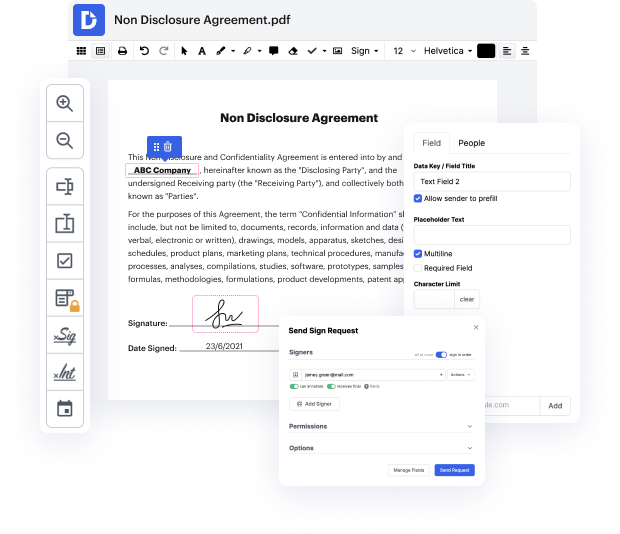

Need to swiftly bold pattern in 1040 Form? Your search is over - DocHub offers the answer! You can get the job done fast without downloading and installing any software. Whether you use it on your mobile phone or desktop browser, DocHub allows you to alter 1040 Form at any time, anywhere. Our comprehensive solution comes with basic and advanced editing, annotating, and security features, suitable for individuals and small companies. We provide lots of tutorials and instructions to make your first experience successful. Here's an example of one!

You don't need to bother about data protection when it comes to 1040 Form editing. We offer such security options to keep your sensitive information secure and safe as folder encryption, dual-factor authentication, and Audit Trail, the latter of which monitors all your actions in your document.