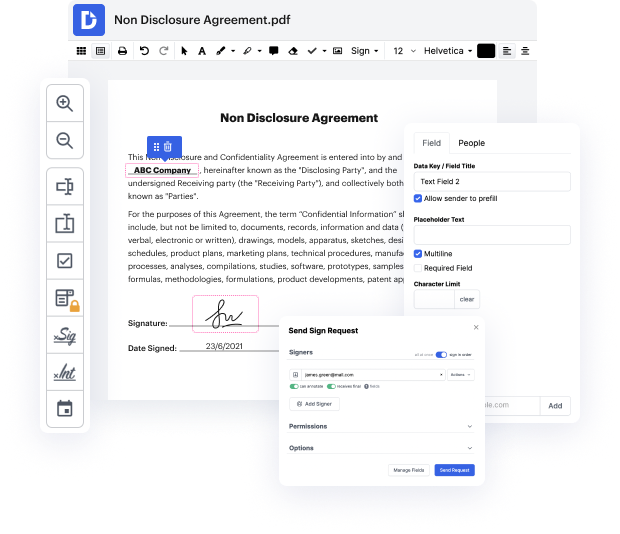

Many people find the process to blot out ein in cgi rather difficult, especially if they don't often work with documents. Nonetheless, these days, you no longer have to suffer through long tutorials or spend hours waiting for the editing app to install. DocHub enables you to modify forms on their web browser without installing new applications. What's more, our powerful service offers a complete set of tools for professional document management, unlike numerous other online tools. That’s right. You no longer have to export and import your forms so frequently - you can do it all in one go!

Whatever type of paperwork you need to modify, the process is easy. Make the most of our professional online service with DocHub!

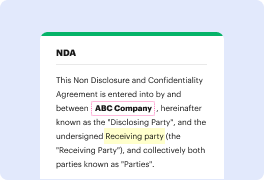

Here are a few tips for small businesses, trusts, estates, charities, and others about the Employer Identification Number or EIN. The EIN serves as a tax ID number for businesses and organizations. First, only the IRS can issue an EIN and itamp;#39;s a free service. Second, you can visit irs.gov/EIN, answer a few questions, and get your EIN immediately online. Third, know who be the responsible party on the application. Generally, a responsible party is someone in control and it must be an individual. You must provide the responsible partyamp;#39;s Social Security Number. Fourth, always keep your EIN information up to date. You need to report changes in responsible party to the IRS within 60 days using Form 8822-B. Use the same form to report changes in address. Finally, your assigned EIN is yours for life. The number is never discontinued. If you close your business, write to the IRS to close your tax account. This is important and will help prevent identity theft. To learn more, vi