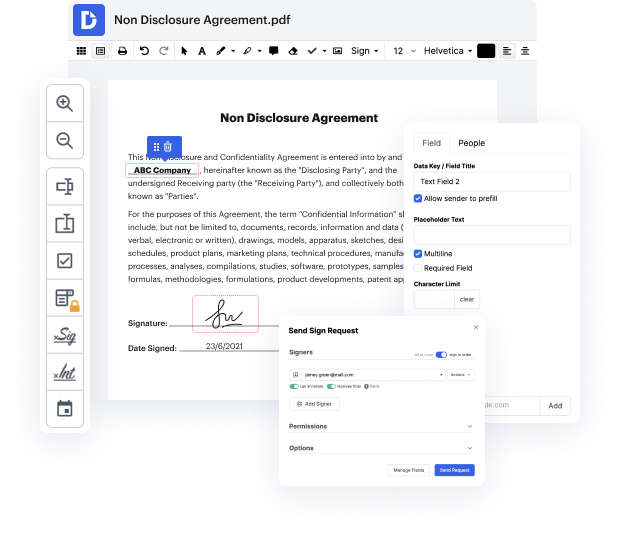

Getting complete control of your documents at any time is vital to alleviate your everyday tasks and enhance your efficiency. Achieve any objective with DocHub tools for document management and hassle-free PDF editing. Access, modify and save and integrate your workflows with other safe cloud storage services.

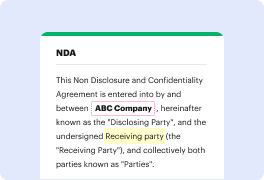

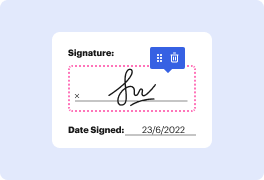

DocHub provides you with lossless editing, the possibility to use any format, and safely eSign documents without having searching for a third-party eSignature alternative. Make the most of your file managing solutions in one place. Check out all DocHub features today with the free profile.

[Music] hello my name is Justin and Im a member of the billing and account steam at the AWS office in Cape Town South Africa today Im going to show you how to obtain a VAT invoice for your AWS usage after your bill is finalized you can download a VAT invoice from the billing and cost management console lets get started from the home page of your billing and cost management console choose builds on the left-hand side of the screen choose the month that youd like a tax invoice for from the date menu drop-down list expand the tax invoices menu click on the tax invoices ID hyperlink to download and save your tax invoice thanks for watching and happy cloud computing from all of us here at AWS [Music] you