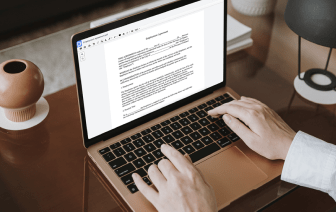

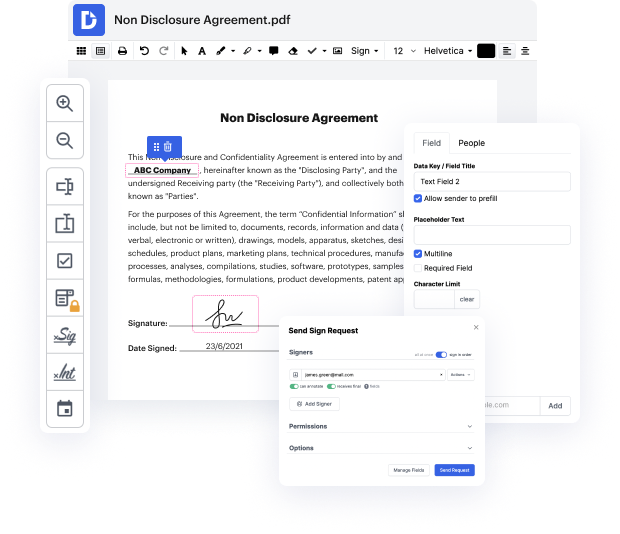

Having full control over your files at any moment is vital to alleviate your day-to-day duties and improve your productivity. Accomplish any objective with DocHub tools for document management and hassle-free PDF editing. Gain access, modify and save and incorporate your workflows with other safe cloud storage.

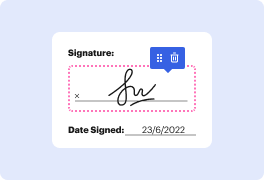

DocHub offers you lossless editing, the opportunity to use any formatting, and securely eSign documents without looking for a third-party eSignature alternative. Get the most of the document managing solutions in one place. Check out all DocHub capabilities right now with your free of charge account.

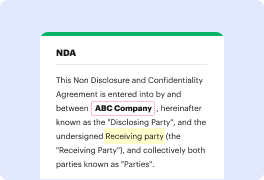

Mergers and acquisitions often report fixed prices, like Company A acquiring Company B for ten million dollars. However, this amount can include contingent payouts, known as earn-outs. An earn-out is an agreement allowing shareholders of the target company (Company B) to receive additional payments based on the company's performance over a specified period. For instance, Company A might pay an upfront amount of ten million dollars and agree to pay an extra five hundred thousand if Company B achieves a net income of two million dollars within the following year. Thus, the total could reach beyond the initial fixed price based on financial achievements.