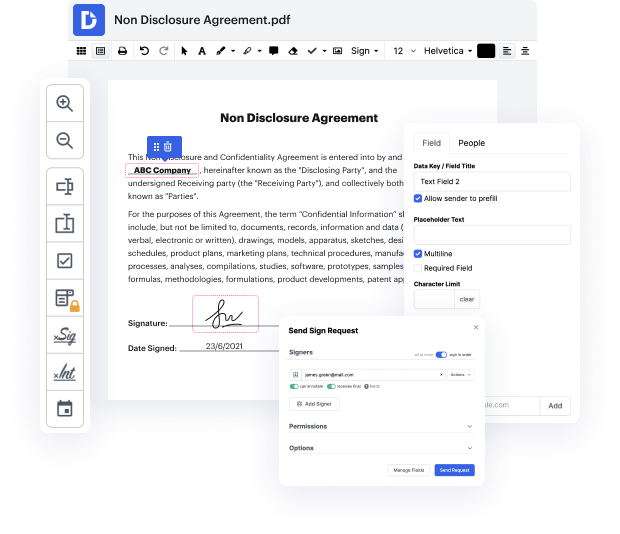

Getting complete control of your papers at any moment is important to relieve your everyday duties and improve your efficiency. Achieve any objective with DocHub tools for document management and hassle-free PDF editing. Gain access, adjust and save and incorporate your workflows along with other protected cloud storage services.

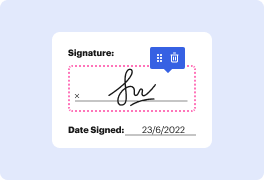

DocHub provides you with lossless editing, the chance to use any format, and safely eSign papers without searching for a third-party eSignature software. Maximum benefit of your document managing solutions in one place. Consider all DocHub functions right now with the free of charge account.

In the Five-Minute Legal Master series, board-certified creditors' rights attorney Nicholas D. Kralik discusses the importance of credit agreements. He emphasizes that while the excitement of acquiring a new customer can overshadow concerns, creditors should proactively consider the risks associated with extending credit. By granting credit, a creditor is essentially lending money, which carries the possibility of non-payment. Kralik advises creditors to prepare for potential collection issues at the start of their business relationship with a new customer. This proactive approach ensures that creditors have the necessary rights and remedies in place before facing any compliance challenges from the debtor.