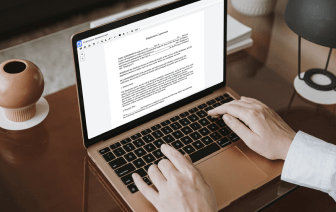

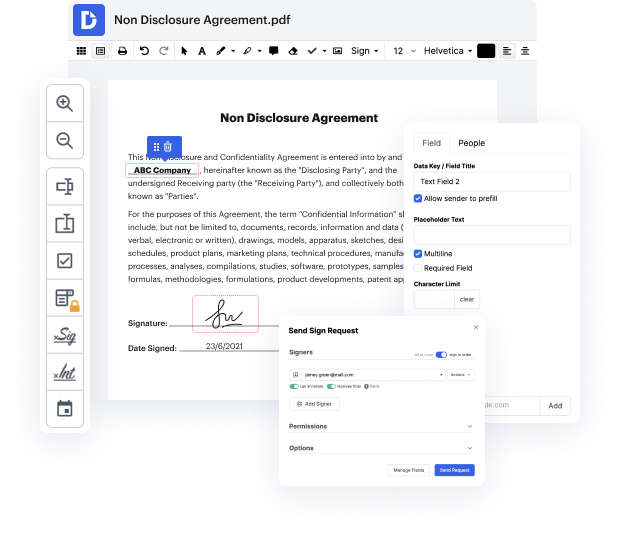

Do you need a quick and easy way to adjust table in Liquidating Trust Agreement? Look no further - DocHub gets the job done fast, with no complicated application. You can use it on your mobile phone and PC, or browser to modify Liquidating Trust Agreement anytime and anywhere. Our comprehensive toolset includes everything from basic and advanced editing to annotating and includes safety measures for individuals and small businesses. We provide tutorials and guides that aid you in getting your business up and running right away. Working with DocHub is as easy as this.

Simple, right? Better still, you don't need to worry about data security. DocHub provides quite a number of features that help you keep your sensitive data safe – encrypted folders, dual-factor authentication, and more. Enjoy the bliss of getting to your document management goals with our reliable and industry-compliant platform, and kiss inefficiency goodbye. Give DocHub a try today!

hey there youtube so in this video i wanted to cover the irs form 966 this is the form for corporate dissolutions or liquidations so if you have a us corporation so this is a lets say a regular corporation for-profit corporation informed under state law or if you have an llc that filed an election to be taxed as a c-corp if you close down that entity you will need to file this form 966 within 30 days after you adopt a plan or resolution to close down the company so i want to run through the form the various elements and the things you need to include with it just to make sure youre doing this as correctly as possible so the top of the form is relatively straightforward right we have the name of the corporation uh here obviously ive got a company delaware company inc not a real business so dont use this uh the mailing address for the company the ein for the company and the type of return were filing right so this is a standard c corp return so 1120 if you have an s corporation th