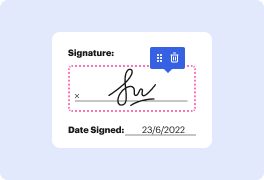

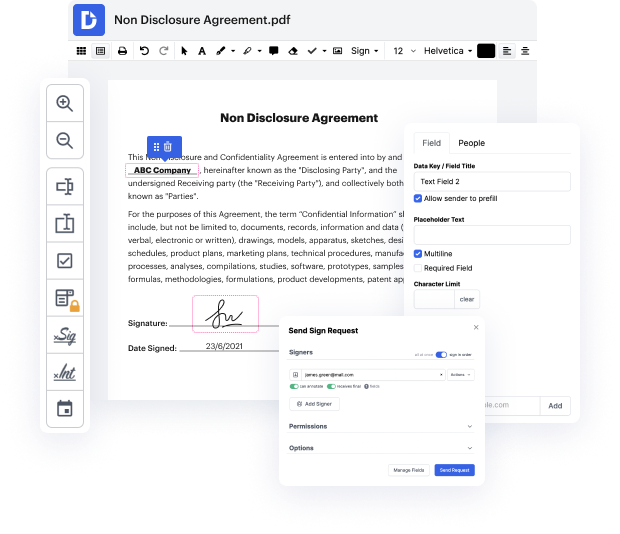

Are you having a hard time choosing a trustworthy solution to Adjust Subsidize Form For Free? DocHub is designed to make this or any other process built around documents much easier. It's straightforward to explore, use, and make changes to the document whenever you need it. You can access the essential tools for dealing with document-based tasks, like certifying, adding text, etc., even with a free plan. Additionally, DocHub integrates with multiple Google Workspace apps as well as services, making document exporting and importing a breeze.

DocHub makes it easier to edit documents from wherever you’re. Additionally, you no longer need to have to print and scan documents back and forth in order to sign them or send them for signature. All the essential tools are at your fingertips! Save time and hassle by executing documents in just a few clicks. Don’t wait another minute today!

"Adjusting Covered California Monthly Subsidy: Kevin Knaus from insurancekevin.com explains how households can adjust their monthly premium tax credit from Covered California. By default, the full subsidy is applied to health insurance premiums, but some may want to lower this amount to reduce their responsibility. This could be necessary if unsure of household changes affecting income or tax dependents. Failure to adjust could result in owing money back or unexpected expenses."

At DocHub, your data security is our priority. We follow HIPAA, SOC2, GDPR, and other standards, so you can work on your documents with confidence.

Learn more