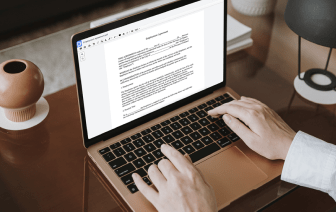

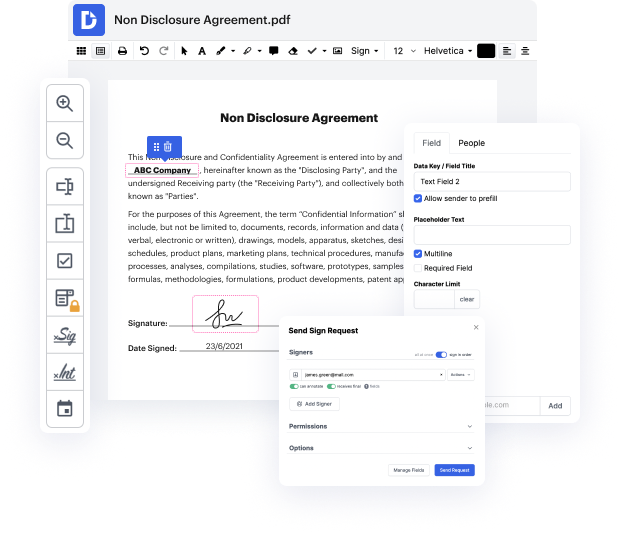

Of course, there’s no ideal software, but you can always get the one that perfectly combines robust functionality, ease of use, and reasonable cost. When it comes to online document management, DocHub provides such a solution! Suppose you need to Add word in Plan of Dissolution and manage paperwork quickly and efficiently. If so, this is the right editor for you - complete your document-related tasks anytime and from any place in only a couple of minutes.

Apart from rich functionality and simplicity, price is another great thing about DocHub. It has flexible and cost-effective subscription plans and allows you to test our service for free during a 30-day trial. Try it out now!

hey there youtube so in this video i wanted to cover the irs form 966 this is the form for corporate dissolutions or liquidations so if you have a us corporation so this is a lets say a regular corporation for-profit corporation informed under state law or if you have an llc that filed an election to be taxed as a c-corp if you close down that entity you will need to file this form 966 within 30 days after you adopt a plan or resolution to close down the company so i want to run through the form the various elements and the things you need to include with it just to make sure youre doing this as correctly as possible so the top of the form is relatively straightforward right we have the name of the corporation uh here obviously ive got a company delaware company inc not a real business so dont use this uh the mailing address for the company the ein for the company and the type of return were filing right so this is a standard c corp return so 1120 if you have an s corporation th