Safety should be the primary consideration when searching for a document editor on the web. There’s no need to spend time browsing for a reliable yet inexpensive tool with enough capabilities to Add watermark in IRS Form 1040-ES. DocHub is just the one you need!

Our solution takes user privacy and data protection into account. It meets industry regulations, like GDPR, CCPA, and PCI DSS, and continuously extends compliance to become even more hazard-free for your sensitive information. DocHub allows you to set up two-factor authentication for your account configurations (via email, Authenticator App, or Backup codes).

For that reason, you can manage any documentation, including the IRS Form 1040-ES, absolutely securely and without hassles.

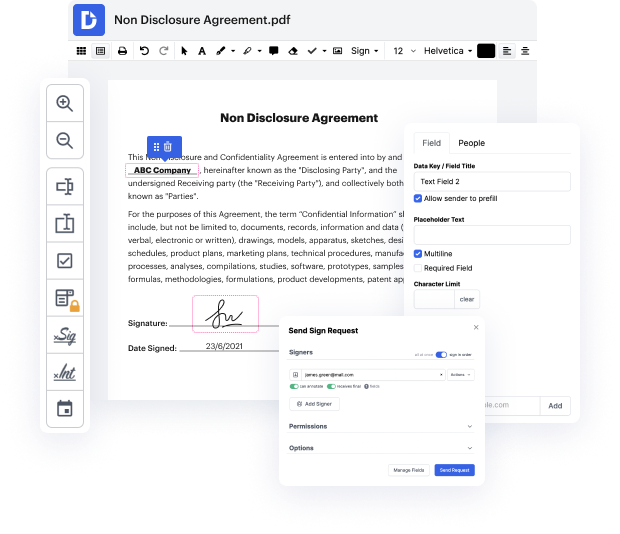

Apart from being reliable, our editor is also extremely easy to work with. Adhere to the guideline below and ensure that managing IRS Form 1040-ES with our tool will take only a few clicks.

If you often manage your paperwork in Google Docs or need to sign attachments you’ve got in Gmail quickly, DocHub is also a good option to choose, as it perfectly integrates with Google services. Make a one-click file import to our editor and complete tasks within minutes instead of continuously downloading and re-uploading your document for editing. Try out DocHub right now!

estimated taxes were never something i had to worry about when i was working my corporate job i got a w-2 i paid my taxes at the end of the year i had taxes withheld from my paycheck because thats what you do when you have a w-2 and you have a normal paycheck as an employee and i wasnt really until i started working for a small business and then i had my own business that estimated taxes became a huge part of my life so uh they might be part of your life too if youre a small business owner and that is what this channel is all about were trying to help small business owners with their financials so this video is all about helping you calculate and helping you understand estimated taxes and estimated tax payments all right so if that sounds interesting to you this is a video that is meant to be timely we are in january we are at the beginning of the year and there is always an estimated tax payment deadline in january so that is why we are putting this video out hopefully its timely

At DocHub, your data security is our priority. We follow HIPAA, SOC2, GDPR, and other standards, so you can work on your documents with confidence.

Learn more