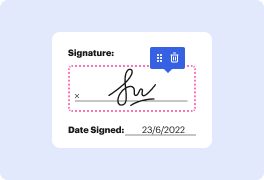

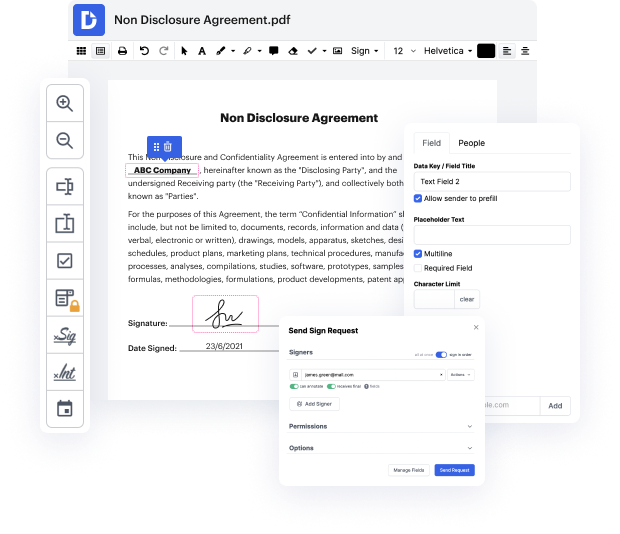

Do you need an editor that will allow you to make that last-minute tweak and Add Stamp Lease For Free? Then you're in the right place! With DocHub, you can quickly make any required changes to your document, no matter its file format. Your output documents will look more professional and compelling-no need to download any software taking up a lot of space. You can use our editor at the convenience of your browser.

When utilizing our editor, stay reassured that your sensitive information is protected and kept from prying eyes. We comply with significant data protection and eCommerce regulations to ensure your experience is secure and enjoyable at every point of interaction with our editor! If you need help editing your document, our dedicated support team is always ready to address all your queries. You can also benefit from our advanced knowledge hub for self-assistance.

Try our editor now and Add Stamp Lease For Free with ease!

Fred Glick discusses real estate management on Glick Watch. He emphasizes the importance of having a rental application, lease agreement, and move in/move out form. It is crucial to ensure that all adults over 18 living in the property apply, provide a valid ID, and undergo credit and background checks. Compliance with federal, state, and local laws is essential throughout the rental process.

At DocHub, your data security is our priority. We follow HIPAA, SOC2, GDPR, and other standards, so you can work on your documents with confidence.

Learn more