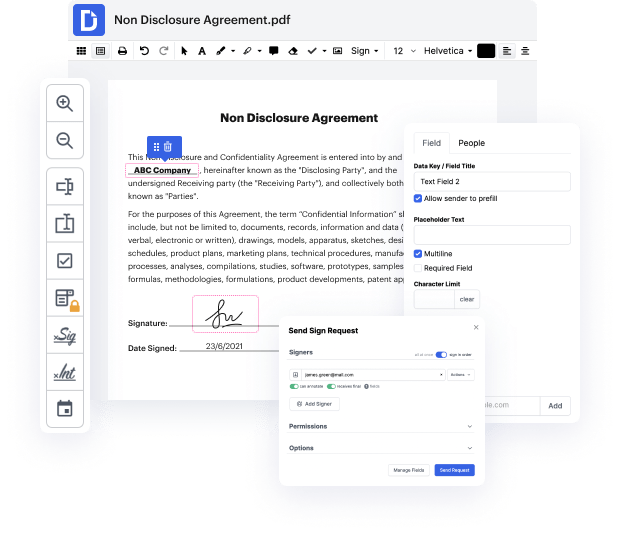

Security should be the first factor when looking for a document editor on the web. There’s no need to waste time browsing for a trustworthy yet inexpensive service with enough features to Adapt design in Factoring Agreement. DocHub is just the one you need!

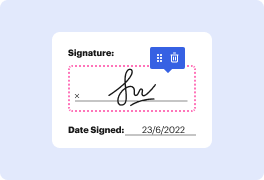

Our tool takes user privacy and data safety into account. It complies with industry standards, like GDPR, CCPA, and PCI DSS, and continuously improves its compliance to become even more hazard-free for your sensitive data. DocHub allows you to set up dual-factor authentication for your account configurations (via email, Authenticator App, or Backup codes).

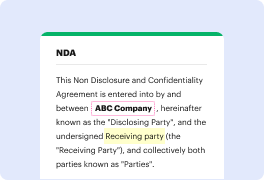

For that reason, you can manage any paperwork, like the Factoring Agreement, risk-free and without hassles.

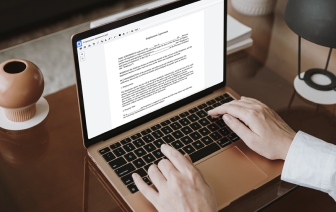

In addition to being reliable, our editor is also extremely simple to work with. Follow the instruction below and ensure that managing Factoring Agreement with our service will take only a couple of clicks.

If you often manage your paperwork in Google Docs or need to sign attachments you’ve got in Gmail quickly, DocHub is also a good option to choose, as it perfectly integrates with Google services. Make a one-click form upload to our editor and complete tasks within minutes instead of continuously downloading and re-uploading your document for processing. Try DocHub today!

hi guys ian johnson from drive success calm today were going to talk about the difference between financing your receivables through a bank and financing your receivables with an asset based financing solution called receivables factoring okay so the reason why Im doing this today is weve had a couple of customers ask me how do you do the comparison how do you do the analysis and what are the benefits to factoring so were going to do that today and this example this entire example is available on my website driving success com theres a sample Excel spreadsheet that has this very same example and you just need to input the different different variables in terms of your interest rates in the days that took the collect on the invoice okay so very quickly with a bank when you finance theyre going to charge you a cost of capital so in our case our yearly interest rate is 6% our daily interest rate is 6% divided by 365 days in a year which gives us point zero one six 4% our cost of goo