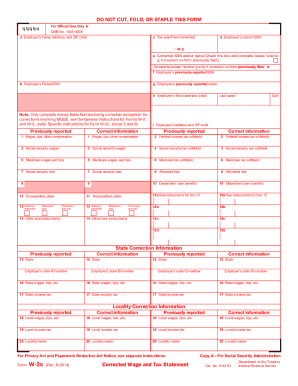

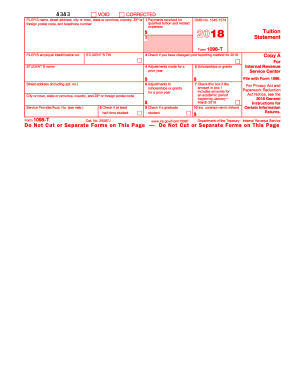

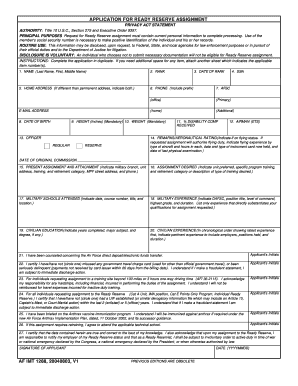

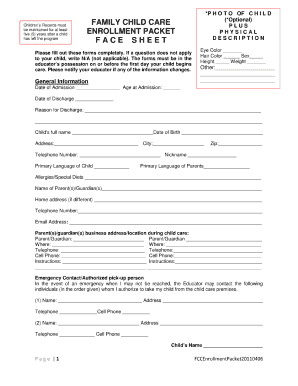

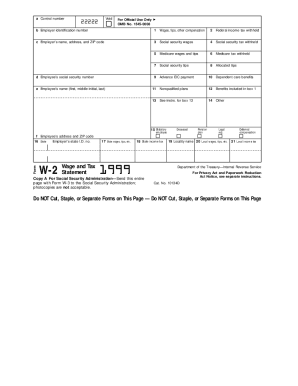

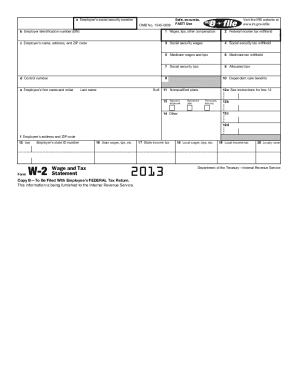

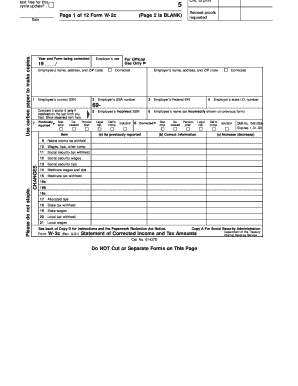

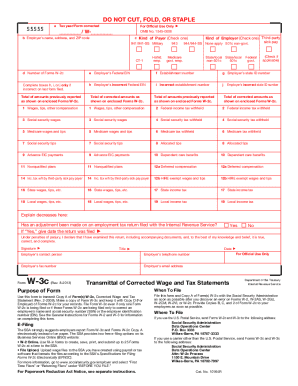

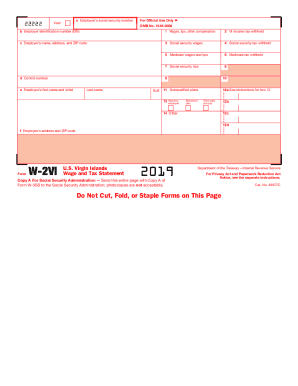

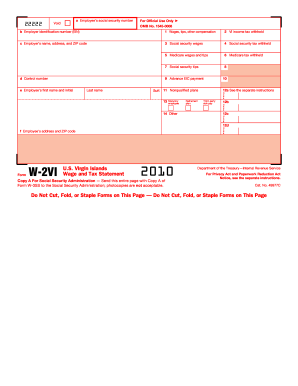

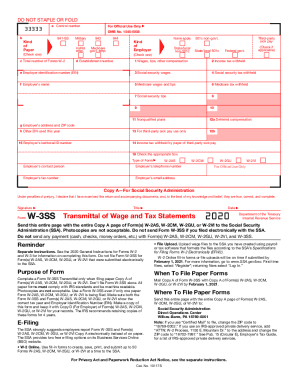

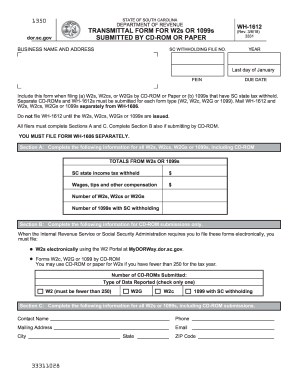

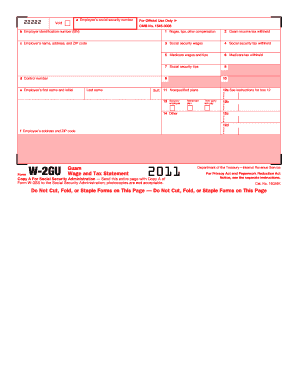

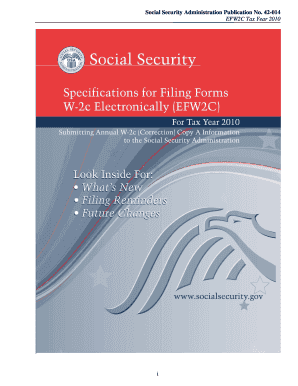

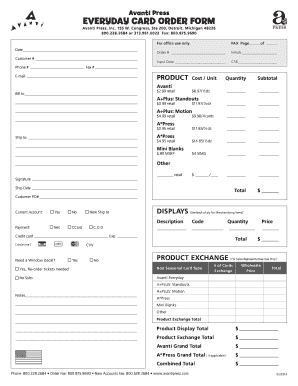

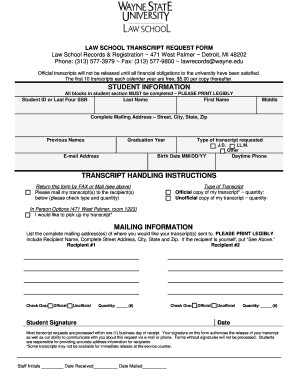

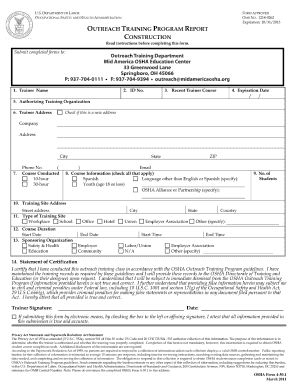

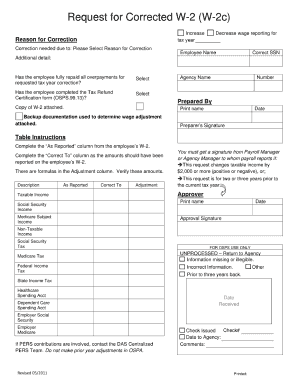

Manage your order forms and browse W2c Order Forms. Keep sensitive information secure with DocHub's data encryption and access controls.

Your workflows always benefit when you are able to locate all the forms and documents you require at your fingertips. DocHub gives a a huge library of templates to alleviate your day-to-day pains. Get hold of W2c Order Forms category and quickly browse for your form.

Begin working with W2c Order Forms in a few clicks:

Enjoy easy record management with DocHub. Explore our W2c Order Forms collection and discover your form right now!