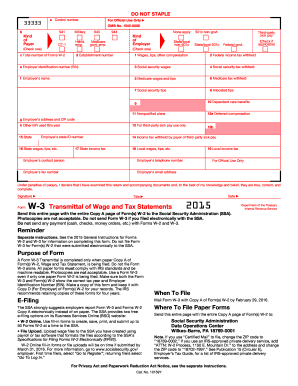

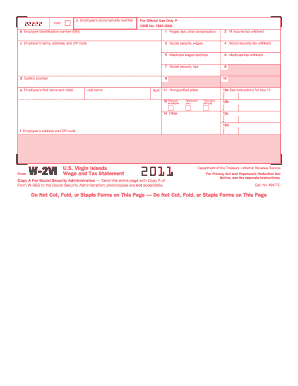

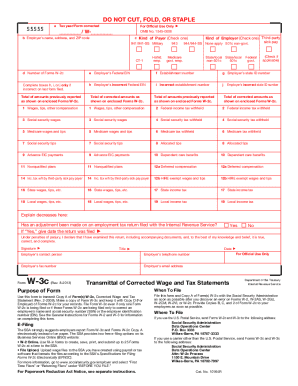

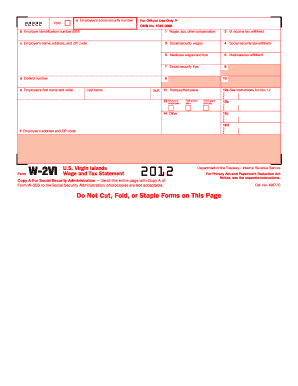

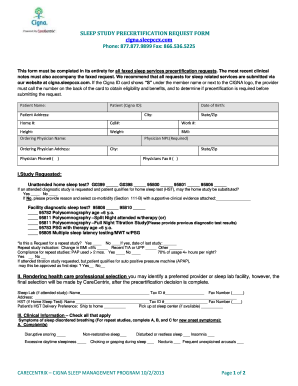

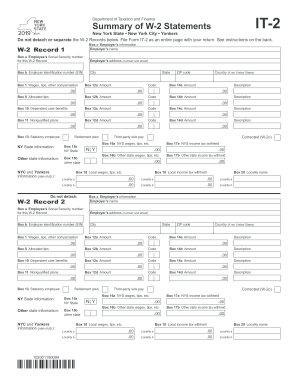

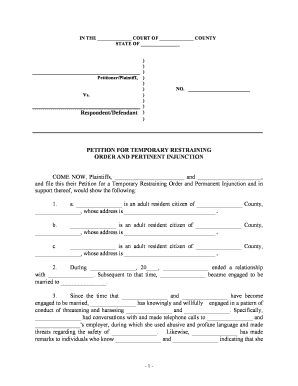

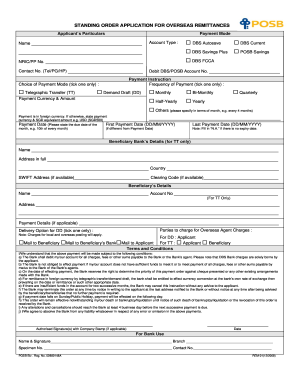

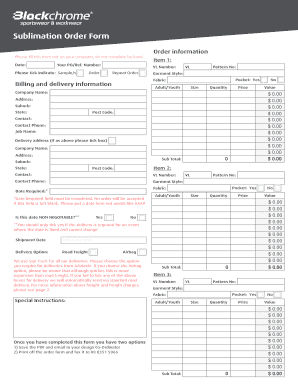

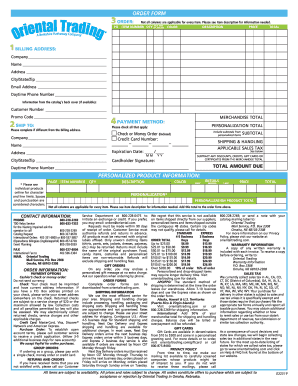

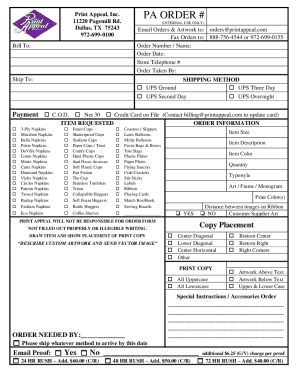

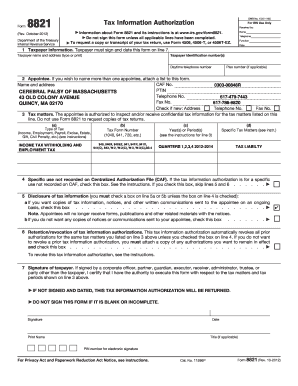

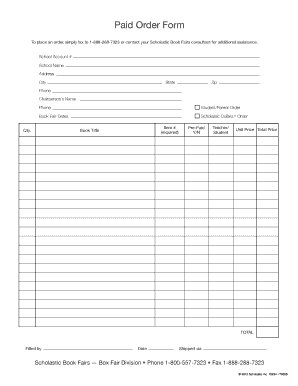

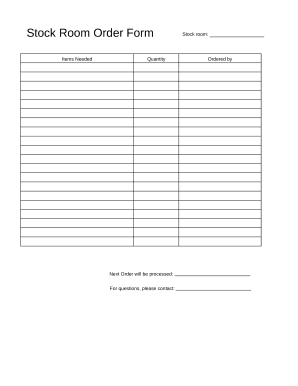

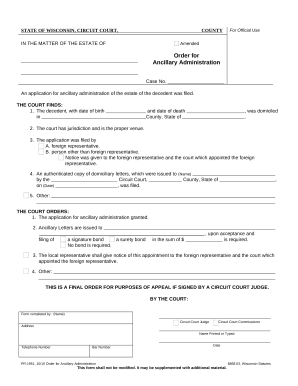

Enhance efficiency with our customizable W2 and Order Forms templates. Adjust and customize forms to fit your specific business requirements in just a few steps.

Speed up your form managing using our W2 and Order Forms online library with ready-made document templates that suit your needs. Get your form template, modify it, complete it, and share it with your contributors without breaking a sweat. Start working more effectively with the forms.

The best way to use our W2 and Order Forms:

Explore all of the possibilities for your online file management with our W2 and Order Forms. Get your free free DocHub account right now!