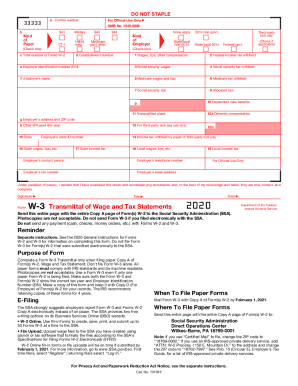

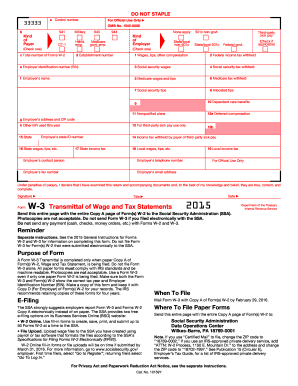

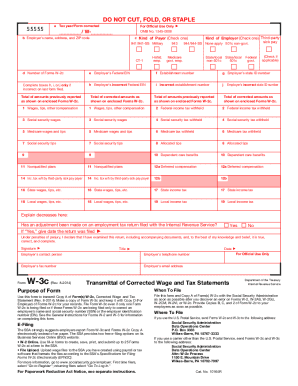

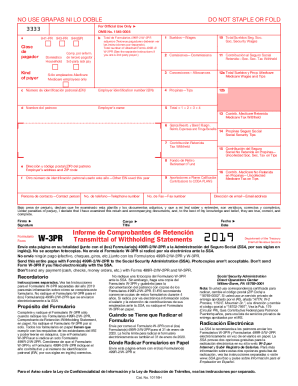

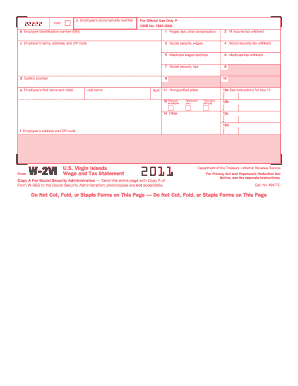

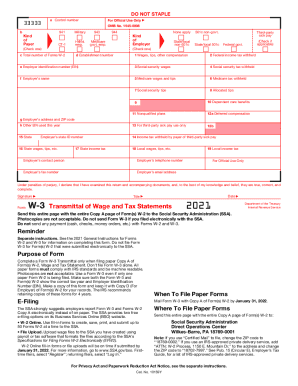

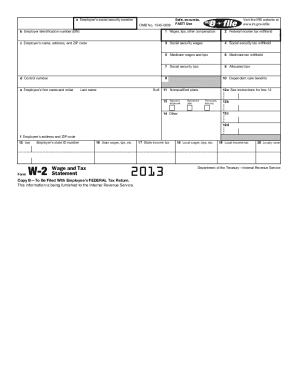

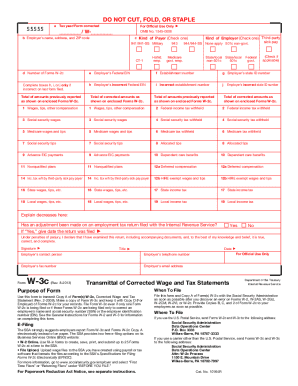

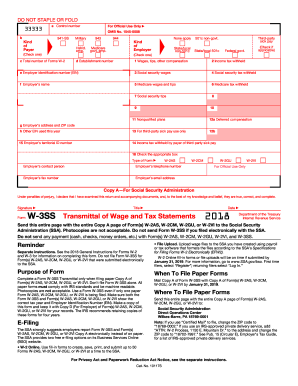

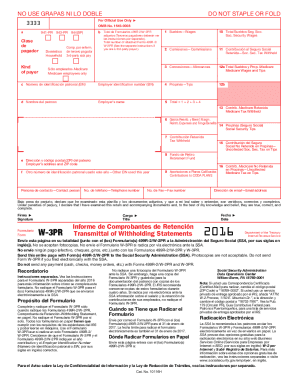

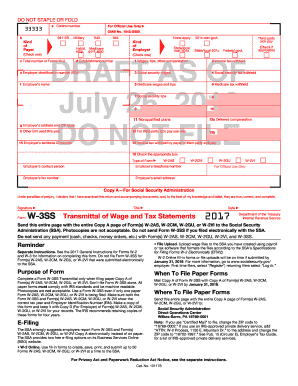

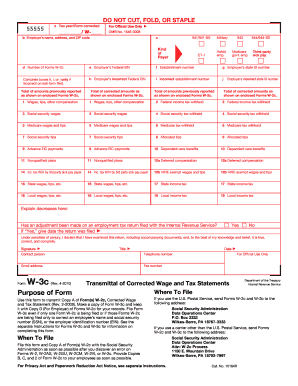

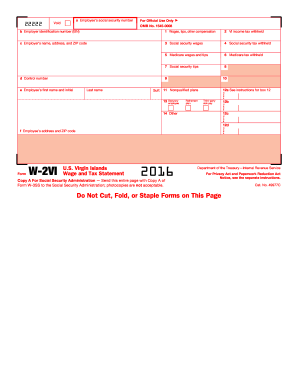

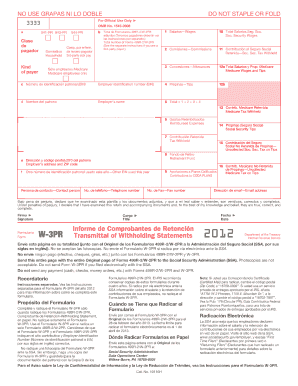

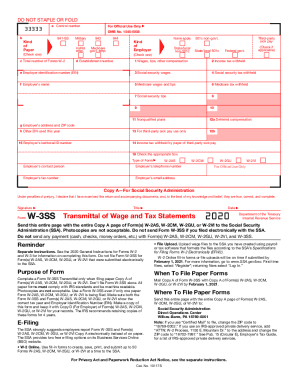

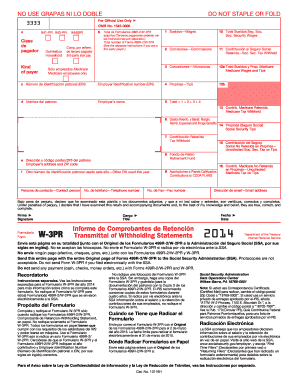

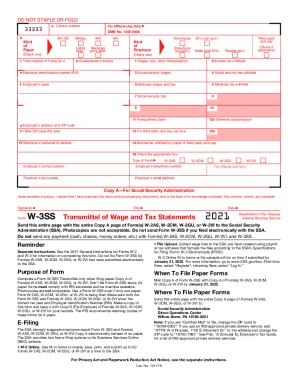

Enhance your document management with DocHub's W 3 from irs Order Forms templates. Edit, distribute, and firmly store your order templates hassle-free.

Speed up your form operations with the W 3 from irs Order Forms library with ready-made document templates that suit your needs. Get the form, alter it, complete it, and share it with your contributors without breaking a sweat. Begin working more effectively with the documents.

The best way to manage our W 3 from irs Order Forms:

Explore all the opportunities for your online document management with our W 3 from irs Order Forms. Get a free free DocHub account right now!