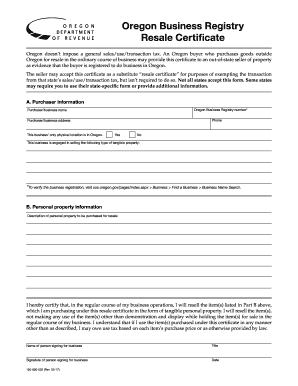

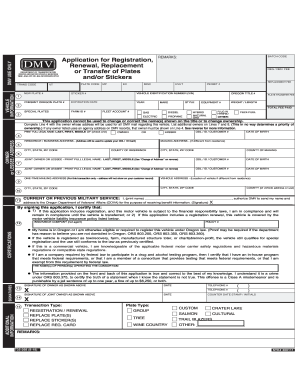

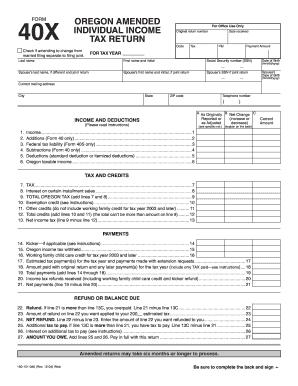

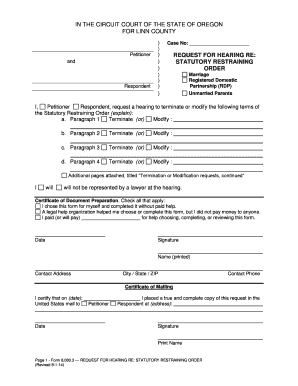

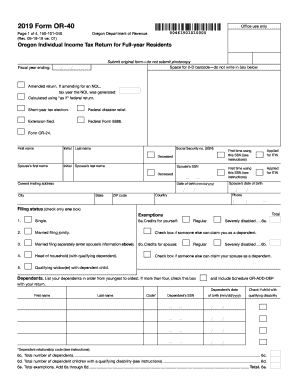

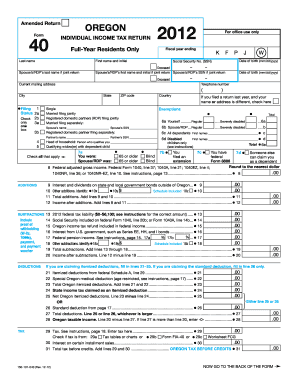

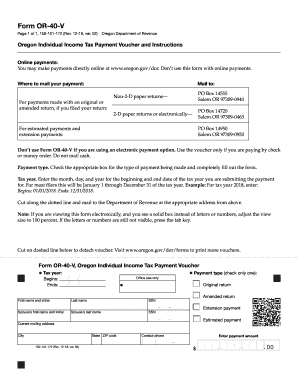

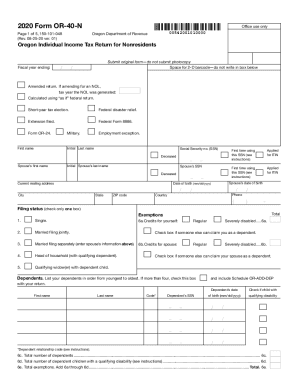

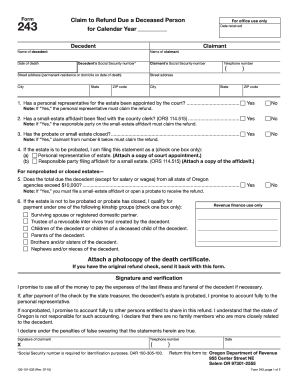

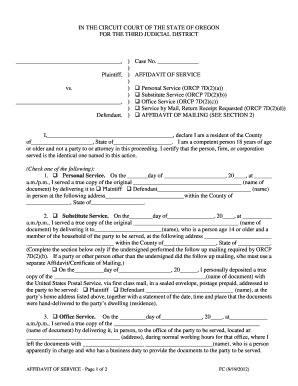

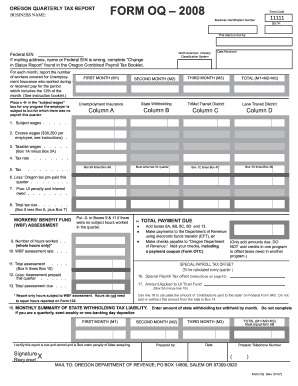

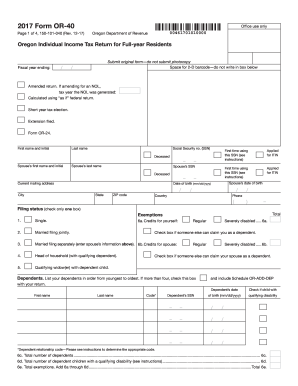

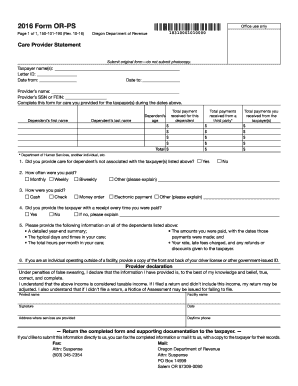

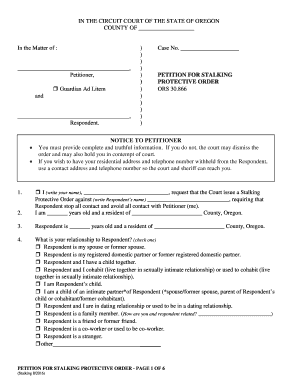

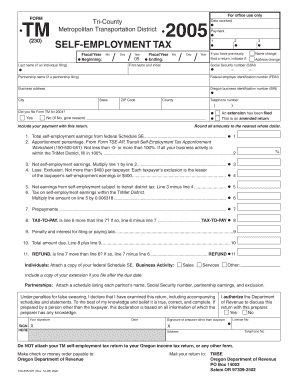

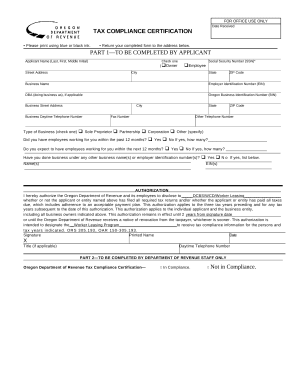

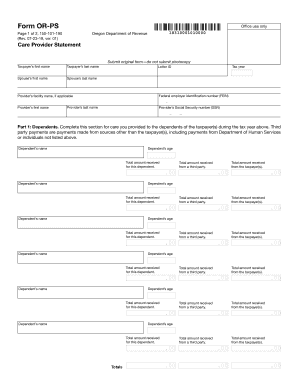

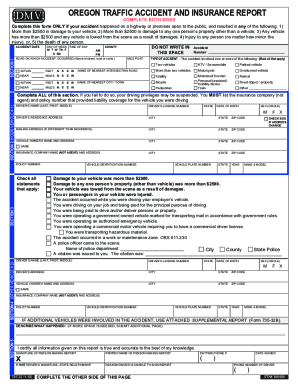

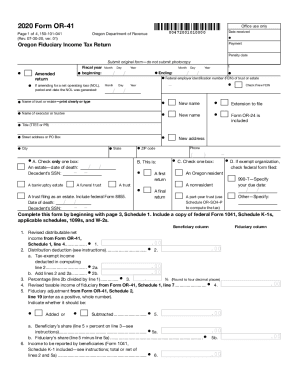

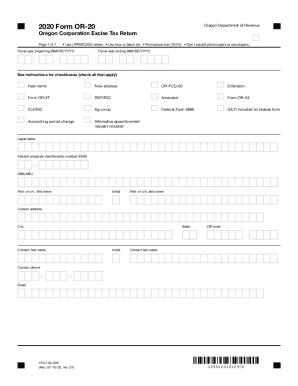

Ensure your company's efficiency with Oregon tax by mail Order Forms templates. Pick order forms, adjust and share them with your customers in a few clicks.

Document administration can overpower you when you can’t discover all of the forms you need. Luckily, with DocHub's considerable form collection, you can find everything you need and easily manage it without the need of switching between software. Get our Oregon tax by mail Order Forms and start working with them.

Using our Oregon tax by mail Order Forms using these easy steps:

Try out DocHub and browse our Oregon tax by mail Order Forms category with ease. Get your free profile right now!