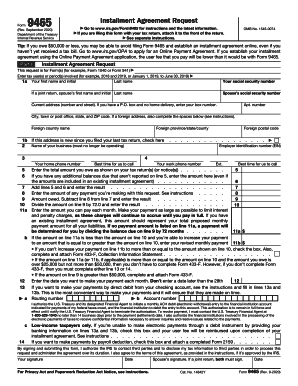

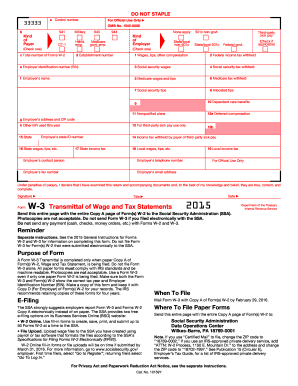

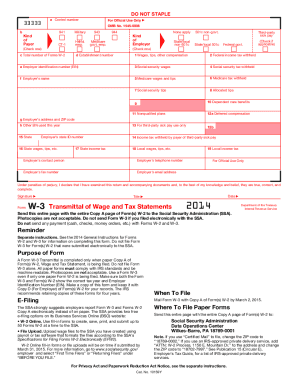

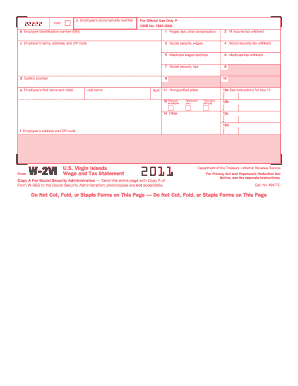

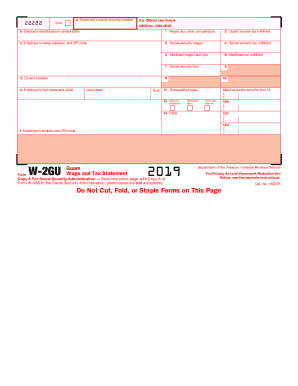

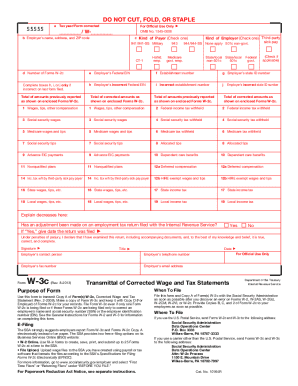

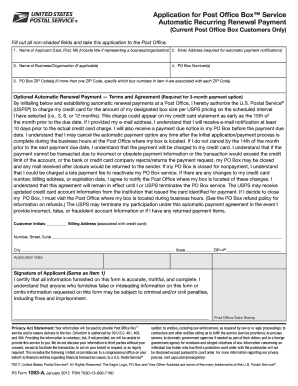

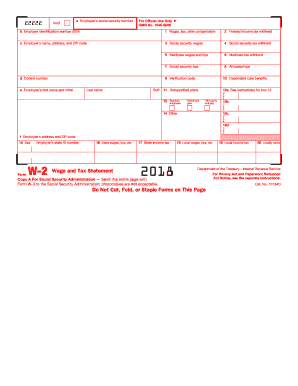

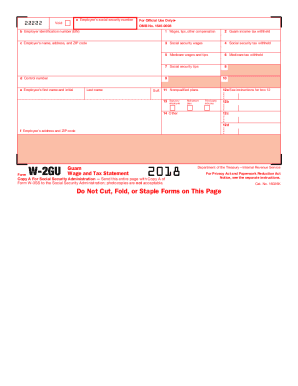

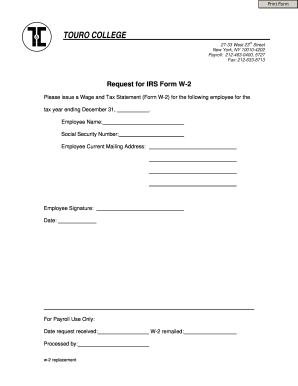

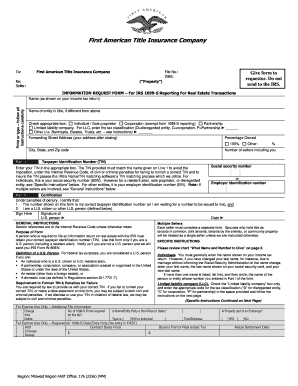

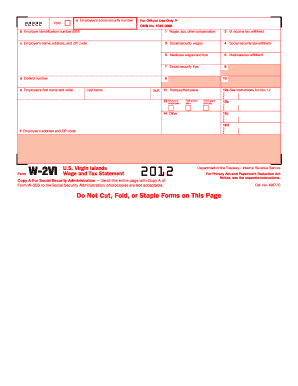

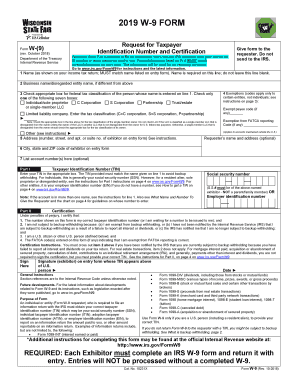

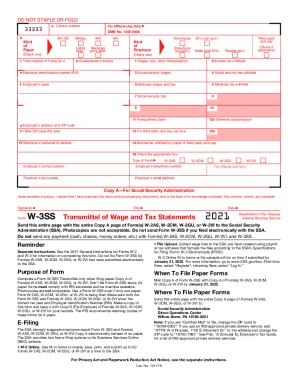

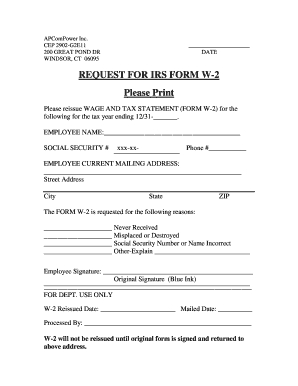

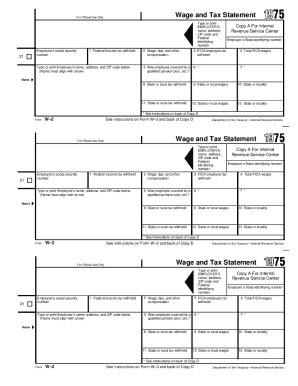

Improve your organization's transparency with Irs w 2 Order Forms. Select and edit templates to ensure your processes stay on the right track.

Papers managing consumes to half of your office hours. With DocHub, it is simple to reclaim your time and effort and boost your team's efficiency. Access Irs w 2 Order Forms online library and discover all templates related to your day-to-day workflows.

Effortlessly use Irs w 2 Order Forms:

Boost your day-to-day file managing with the Irs w 2 Order Forms. Get your free DocHub account right now to discover all templates.