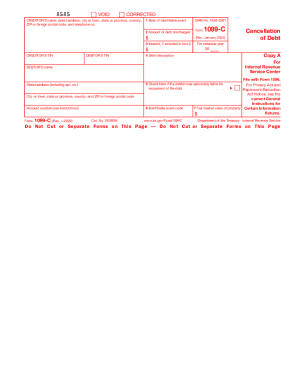

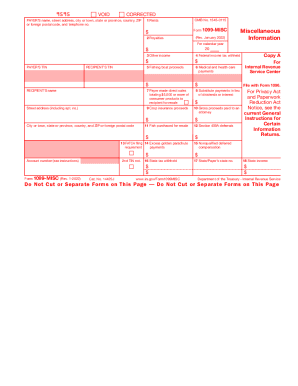

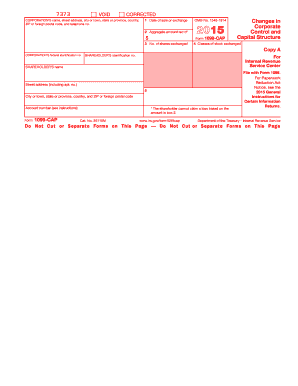

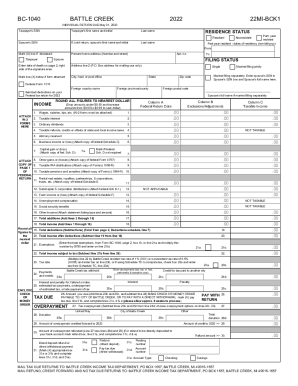

Ensure your process security and compliance with Irs tax 1099 Order Forms template catalog. Locate up-to-date documents and organize them online in several steps.

Your workflows always benefit when you are able to obtain all of the forms and documents you need at your fingertips. DocHub offers a vast array of form templates to ease your everyday pains. Get a hold of Irs tax 1099 Order Forms category and quickly browse for your form.

Start working with Irs tax 1099 Order Forms in several clicks:

Enjoy seamless form management with DocHub. Check out our Irs tax 1099 Order Forms online library and look for your form today!