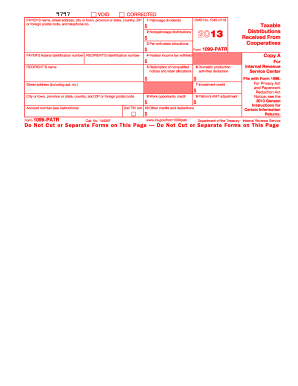

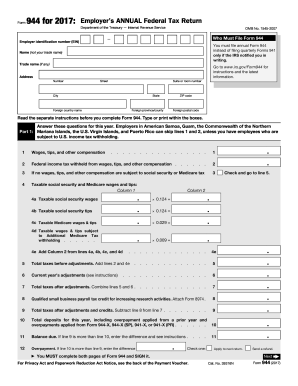

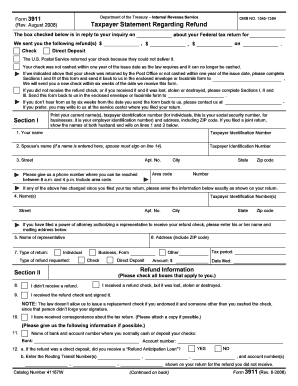

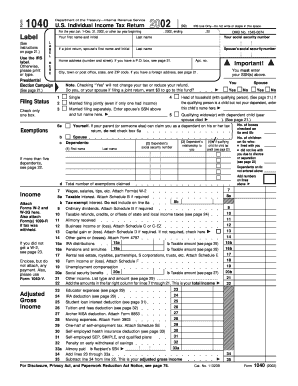

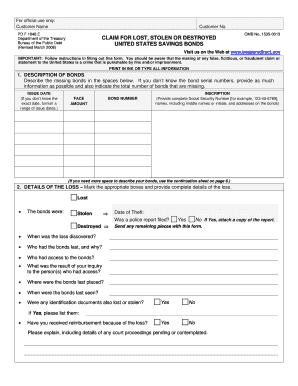

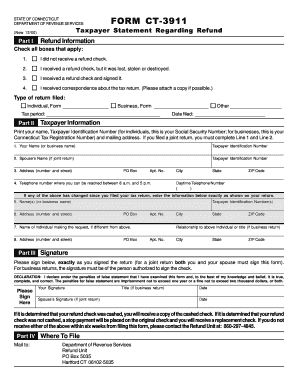

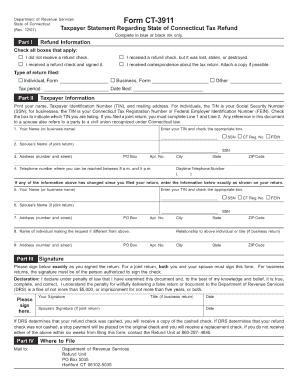

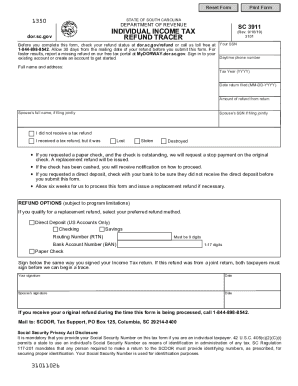

Find relevant forms with Irs missing tax Order Forms catalog. Pick the form, adjust and distribute it, and safely keep finished documents in your DocHub profile.

Speed up your document management with our Irs missing tax Order Forms category with ready-made form templates that meet your requirements. Access the form template, modify it, fill it, and share it with your contributors without breaking a sweat. Start working more effectively together with your documents.

How to use our Irs missing tax Order Forms:

Discover all the possibilities for your online document administration with the Irs missing tax Order Forms. Get a free free DocHub profile right now!