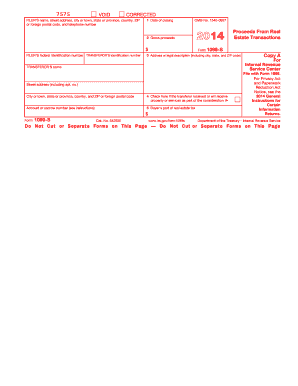

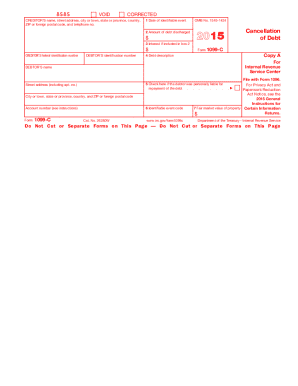

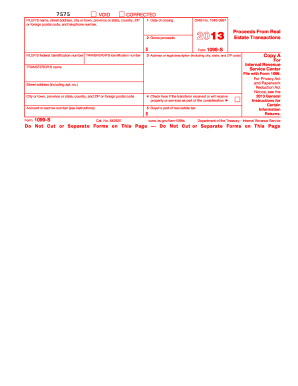

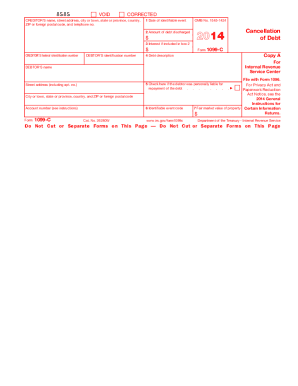

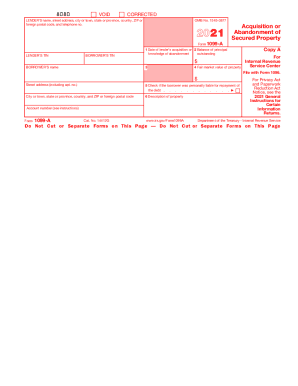

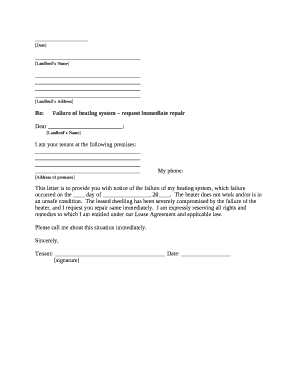

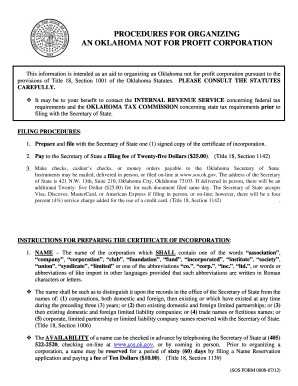

Boost efficiency with our customizable Irs 1099a 1096 Order Forms templates. Modify and tailor forms to fit your specific business needs in just a few clicks.

Speed up your file management with the Irs 1099a 1096 Order Forms online library with ready-made form templates that meet your requirements. Get the form, alter it, complete it, and share it with your contributors without breaking a sweat. Begin working more effectively with your forms.

The best way to manage our Irs 1099a 1096 Order Forms:

Examine all the opportunities for your online document management using our Irs 1099a 1096 Order Forms. Get your totally free DocHub account right now!