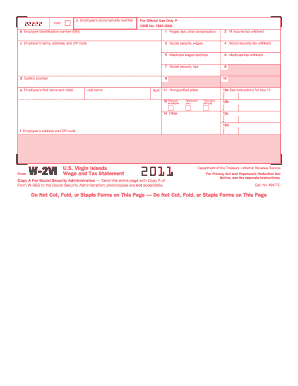

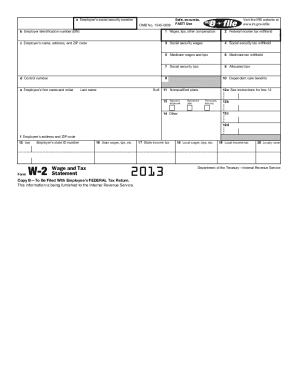

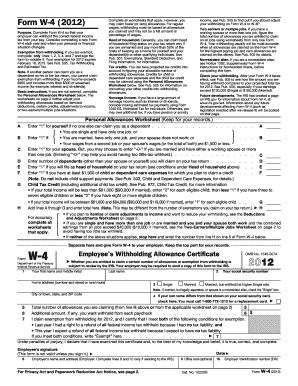

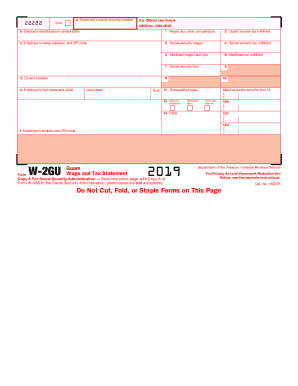

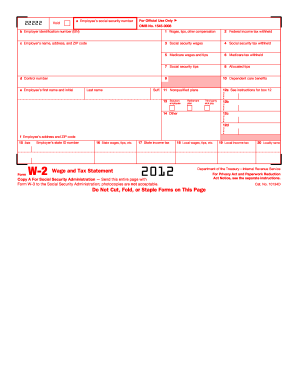

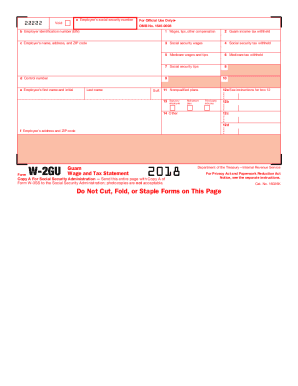

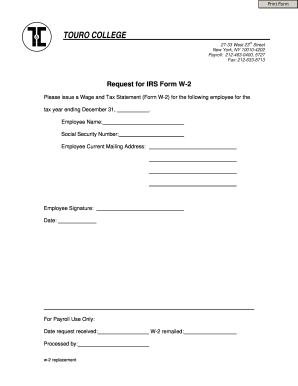

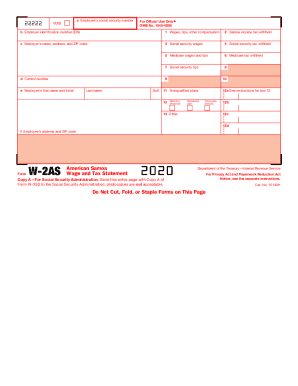

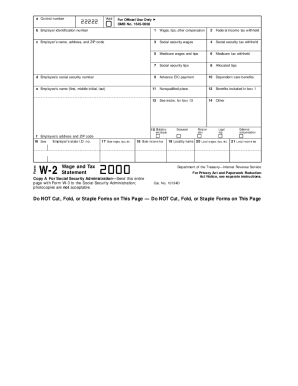

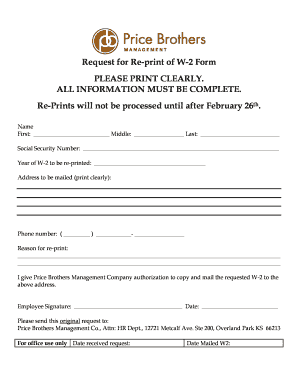

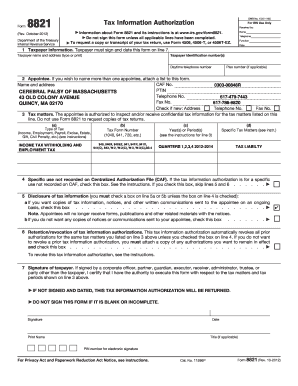

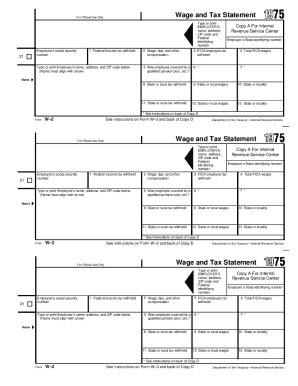

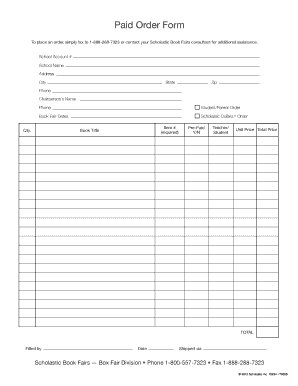

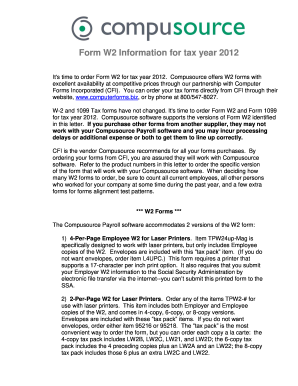

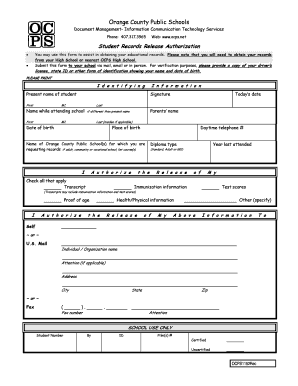

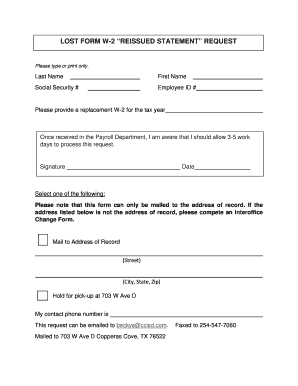

Find relevant documents with Blank w2 Order Forms collection. Choose the document, adjust and send it, and safely keep finished documents in your DocHub profile.

Accelerate your document management with the Blank w2 Order Forms collection with ready-made document templates that suit your needs. Access the document, modify it, complete it, and share it with your contributors without breaking a sweat. Begin working more effectively with the documents.

The best way to use our Blank w2 Order Forms:

Discover all of the possibilities for your online document administration with our Blank w2 Order Forms. Get a totally free DocHub account right now!