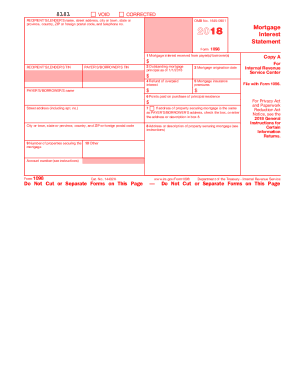

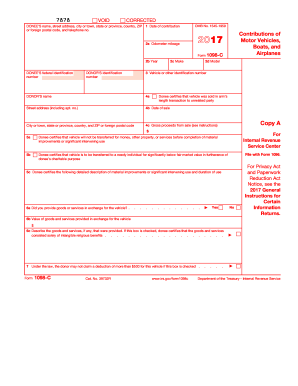

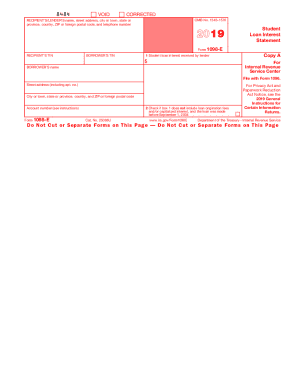

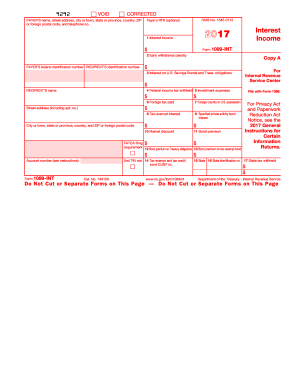

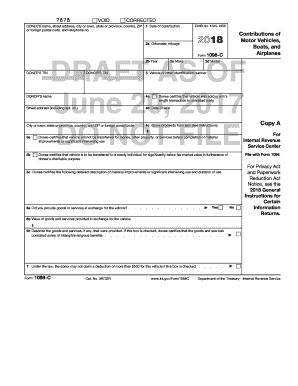

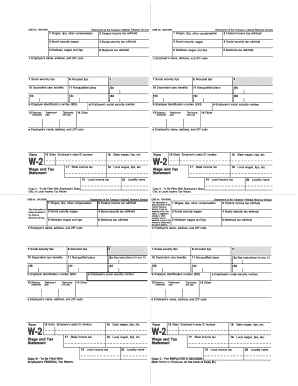

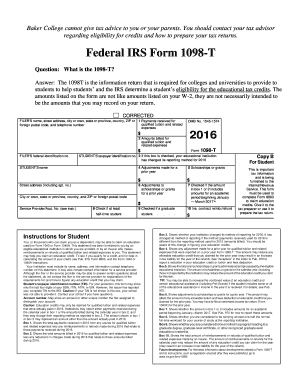

Manage your order documents and browse 1098 Order Forms. Keep sensitive information safe with DocHub's encryption technology and access controls.

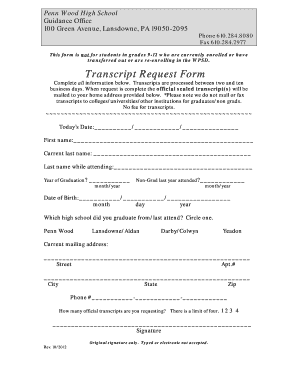

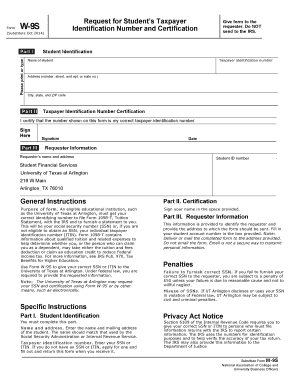

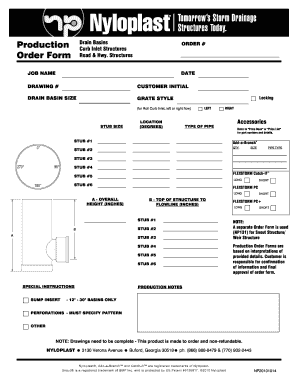

Your workflows always benefit when you can easily find all of the forms and documents you need at your fingertips. DocHub gives a huge selection of forms to ease your daily pains. Get a hold of 1098 Order Forms category and quickly browse for your form.

Start working with 1098 Order Forms in a few clicks:

Enjoy smooth form administration with DocHub. Explore our 1098 Order Forms online library and discover your form today!