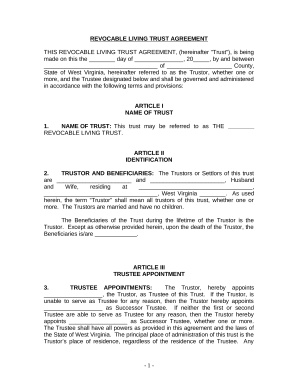

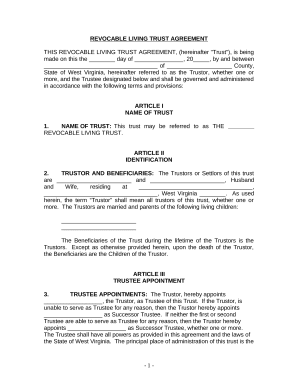

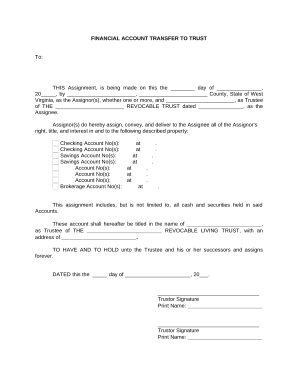

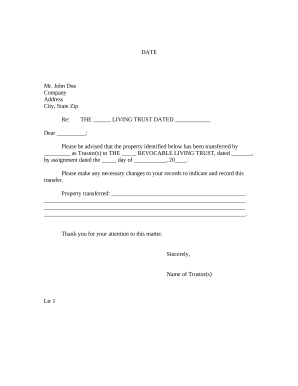

Boost your form management with the West Virginia Living Trusts online library with ready-made document templates that meet your requirements. Get the form, change it, fill it, and share it with your contributors without breaking a sweat. Begin working more efficiently with your forms.

How to use our West Virginia Living Trusts:

Examine all of the possibilities for your online file management using our West Virginia Living Trusts. Get your totally free DocHub account today!