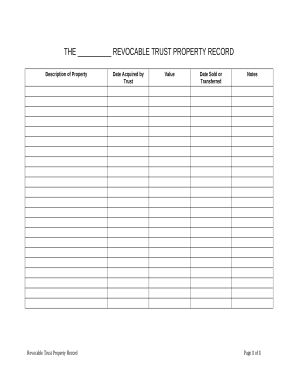

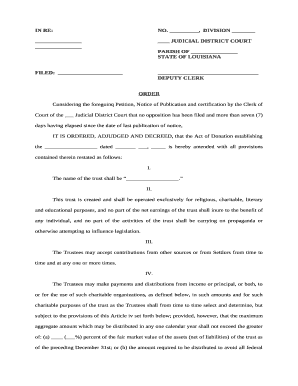

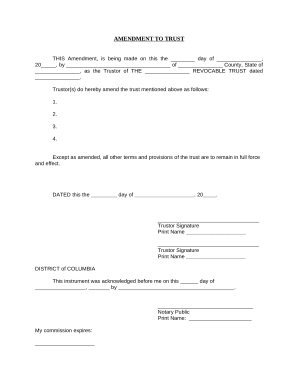

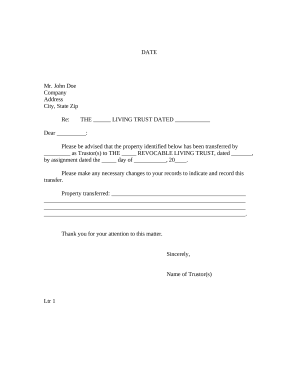

Boost your file managing with the US Trusts and Estates collection with ready-made form templates that meet your requirements. Get your document template, change it, fill it, and share it with your contributors without breaking a sweat. Begin working more efficiently with the forms.

The best way to use our US Trusts and Estates:

Discover all of the opportunities for your online file management using our US Trusts and Estates. Get a totally free DocHub account right now!