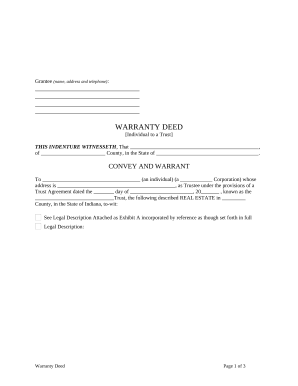

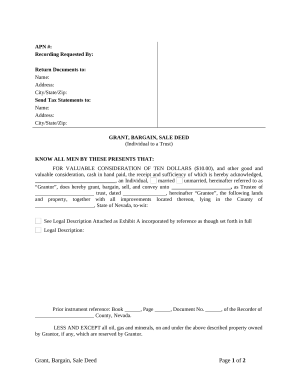

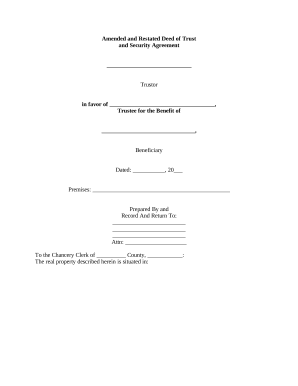

Accelerate your document managing using our US trust deed forms collection with ready-made document templates that meet your needs. Get the document, edit it, complete it, and share it with your contributors without breaking a sweat. Begin working more effectively with the forms.

How to use our US trust deed forms:

Explore all of the possibilities for your online document administration using our US trust deed forms. Get a totally free DocHub account right now!