First, sign in to your DocHub account. If you don't have one, you can simply sign up for free.

Once signed in, head to your dashboard. This is your primary hub for all document-related activities.

In your dashboard, hit New Document in the upper left corner. Hit Create Blank Document to build the US Loan and Lending Form from scratch.

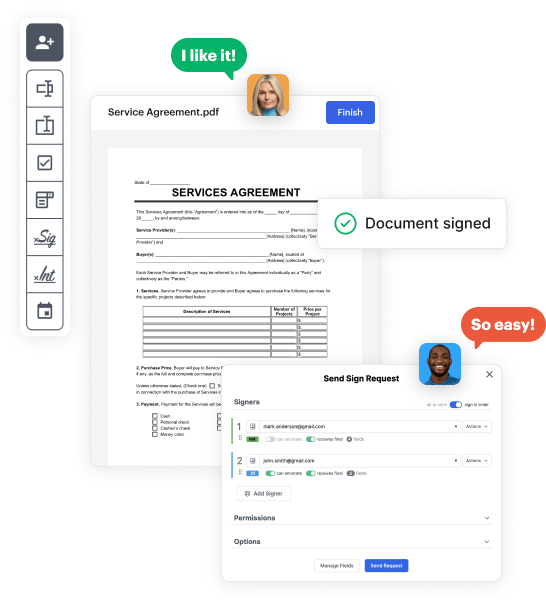

Add various elements like text boxes, images, signature fields, and other options to your form and designate these fields to intended recipients as required.

Personalize your form by inserting walkthroughs or any other essential tips utilizing the text feature.

Carefully go over your created US Loan and Lending Form for any mistakes or essential adjustments. Take advantage of DocHub's editing tools to polish your template.

After finalizing, save your copy. You may opt to save it within DocHub, transfer it to various storage options, or send it via a link or email.