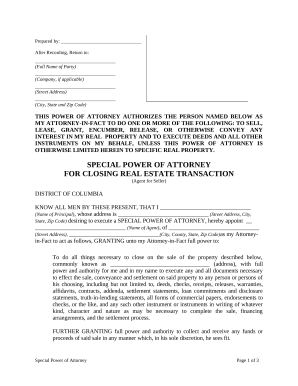

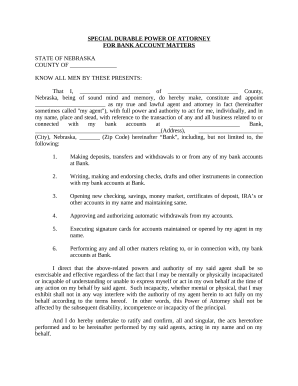

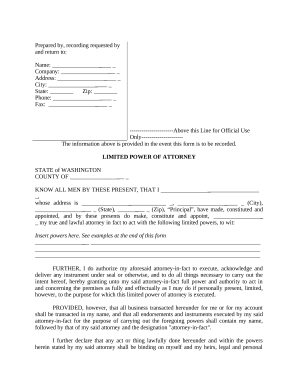

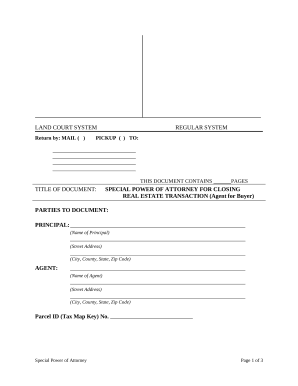

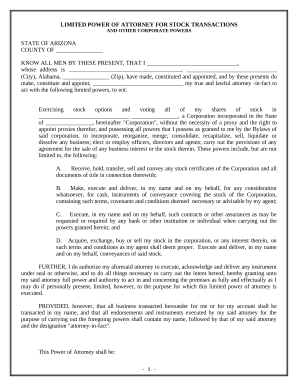

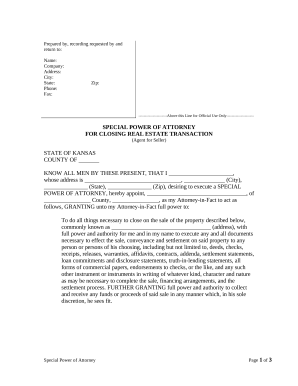

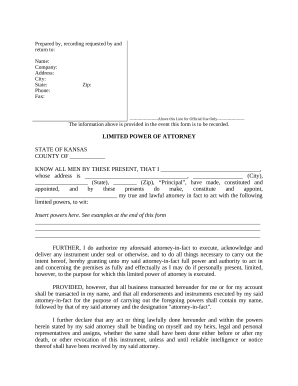

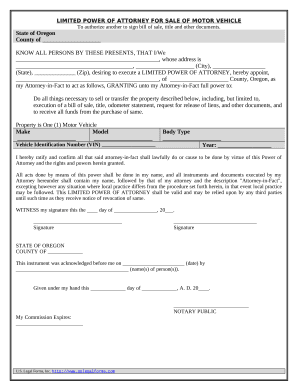

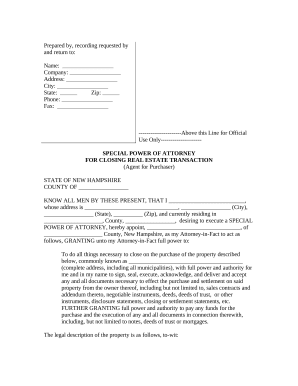

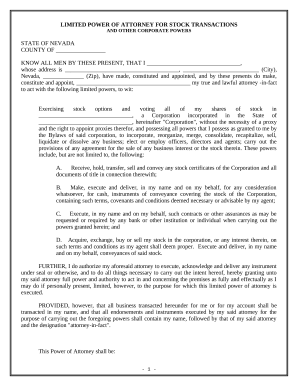

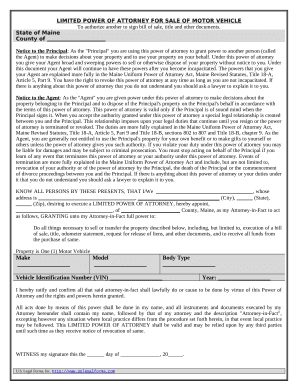

Your workflows always benefit when you can find all the forms and documents you require on hand. DocHub delivers a wide array of forms to relieve your daily pains. Get hold of US Limited Power of Attorney Forms category and quickly browse for your document.

Begin working with US Limited Power of Attorney Forms in several clicks:

Enjoy seamless form managing with DocHub. Check out our US Limited Power of Attorney Forms category and locate your form right now!