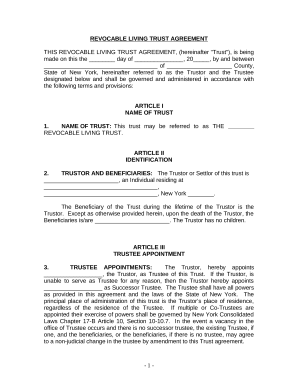

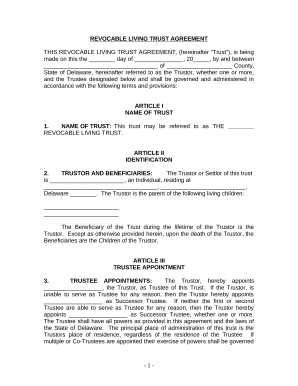

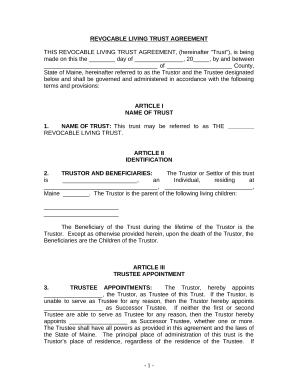

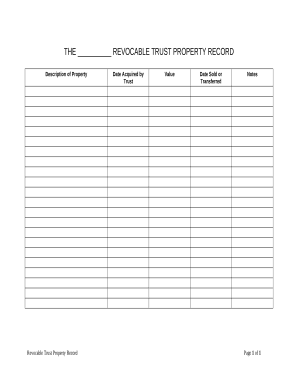

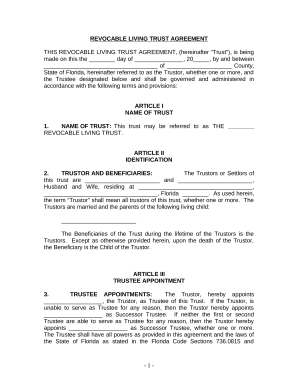

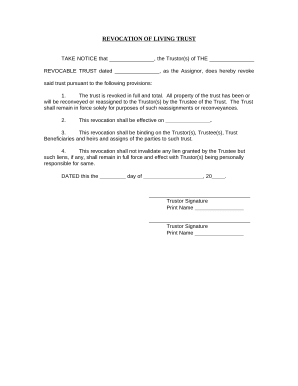

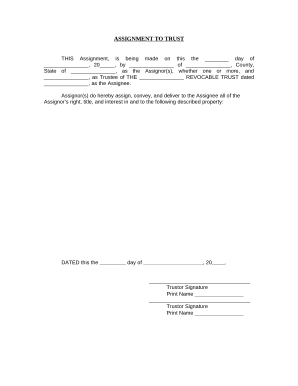

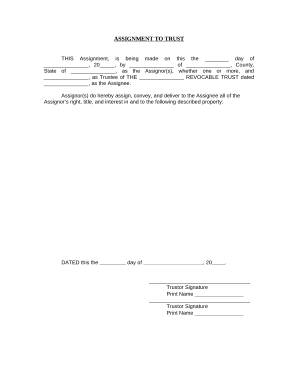

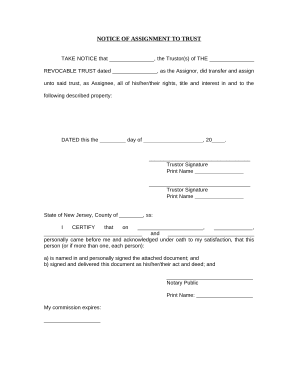

Boost your document managing with the US Legal Trusts collection with ready-made templates that suit your requirements. Get the form template, modify it, fill it, and share it with your contributors without breaking a sweat. Start working more effectively together with your documents.

How to use our US Legal Trusts:

Explore all of the possibilities for your online document management with our US Legal Trusts. Get your free free DocHub account today!