Your workflows always benefit when you can find all of the forms and files you will need on hand. DocHub provides a a huge collection of document templates to ease your everyday pains. Get a hold of US Deeds of Trust Forms category and easily discover your document.

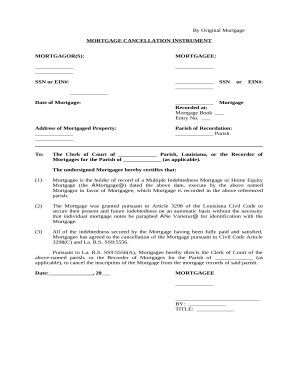

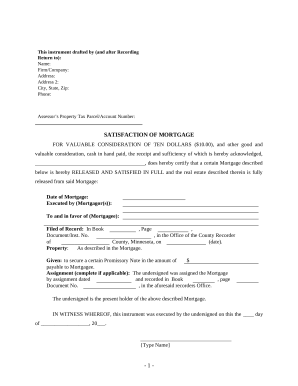

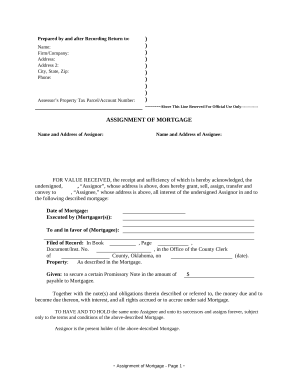

Start working with US Deeds of Trust Forms in a few clicks:

Enjoy fast and easy form management with DocHub. Check out our US Deeds of Trust Forms category and get your form right now!