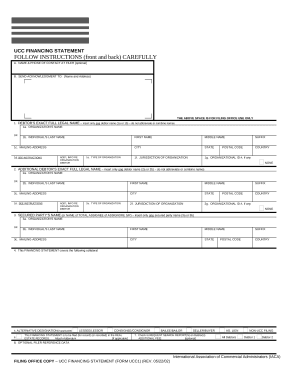

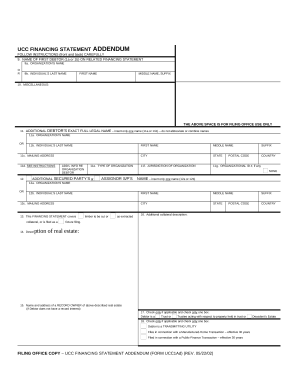

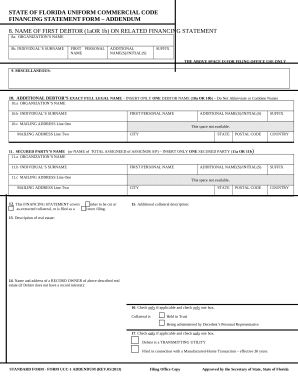

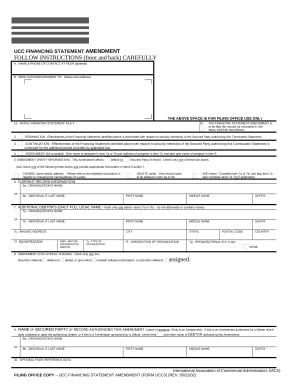

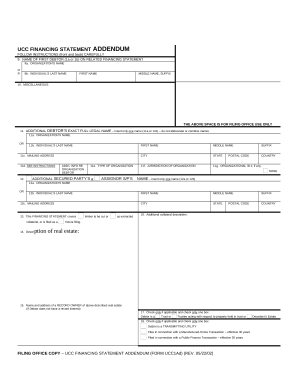

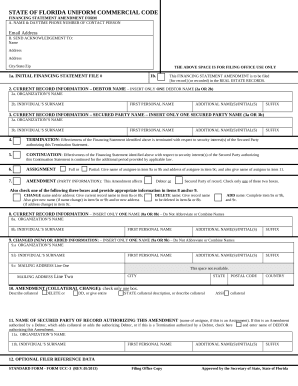

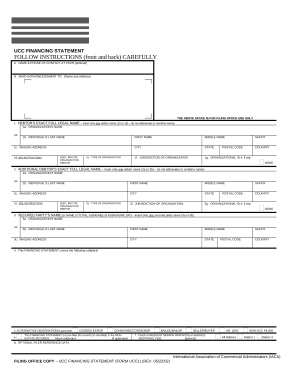

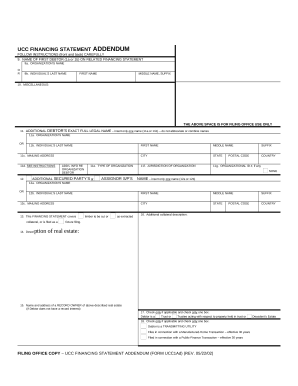

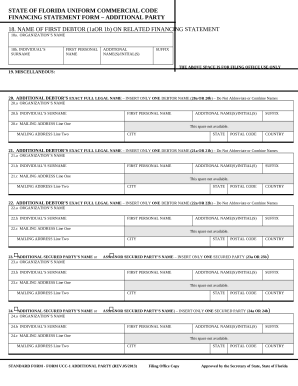

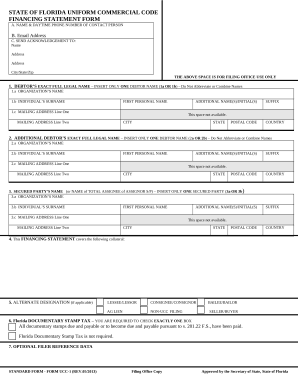

Boost your file operations with our UCC Financing Statement Forms collection with ready-made templates that suit your needs. Access your form, alter it, fill it, and share it with your contributors without breaking a sweat. Start working more effectively with your forms.

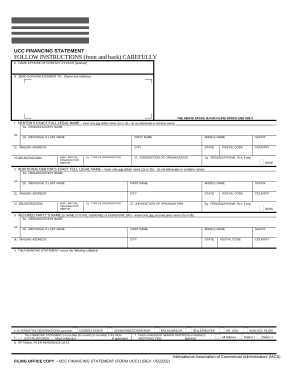

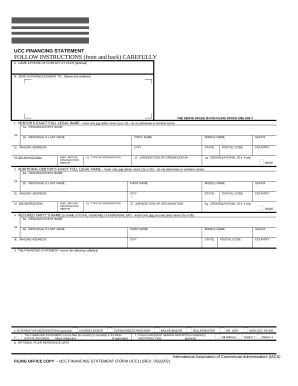

The best way to manage our UCC Financing Statement Forms:

Examine all of the possibilities for your online file management with the UCC Financing Statement Forms. Get a free free DocHub account right now!