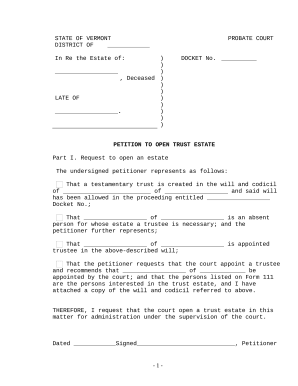

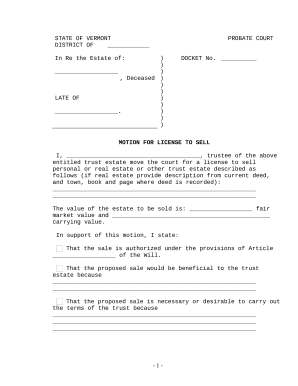

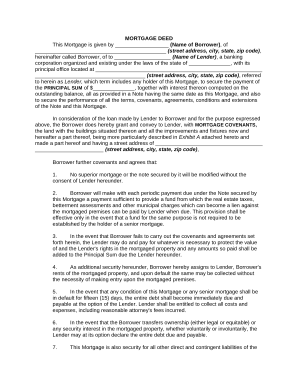

Papers management consumes to half of your business hours. With DocHub, it is possible to reclaim your office time and enhance your team's efficiency. Get Trust Estate Forms category and investigate all form templates relevant to your everyday workflows.

Effortlessly use Trust Estate Forms:

Improve your everyday file management with our Trust Estate Forms. Get your free DocHub profile right now to discover all templates.