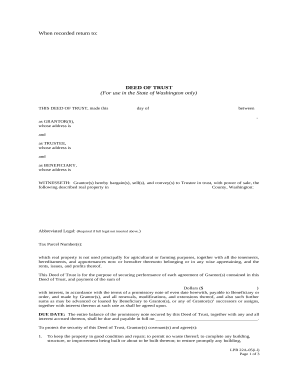

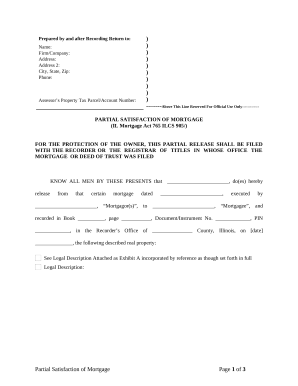

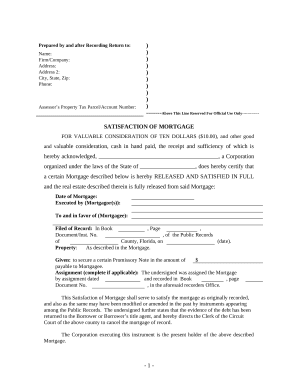

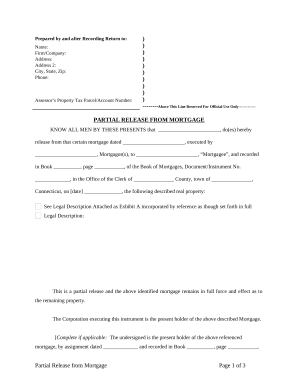

Papers administration takes up to half of your office hours. With DocHub, you can easily reclaim your time and effort and boost your team's productivity. Get Trust Deeds Legal Documents collection and discover all document templates related to your day-to-day workflows.

Effortlessly use Trust Deeds Legal Documents:

Improve your day-to-day file administration with our Trust Deeds Legal Documents. Get your free DocHub account right now to discover all templates.