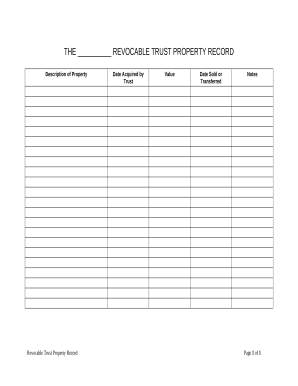

Your workflows always benefit when you can easily find all the forms and files you require at your fingertips. DocHub delivers a a large collection documents to ease your daily pains. Get a hold of Trust Creation Forms category and quickly browse for your form.

Begin working with Trust Creation Forms in a few clicks:

Enjoy fast and easy record management with DocHub. Discover our Trust Creation Forms online library and locate your form right now!