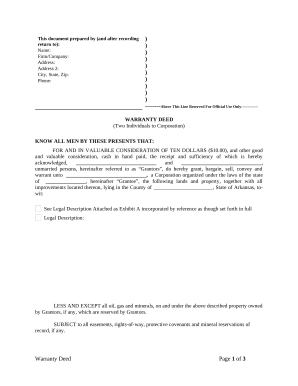

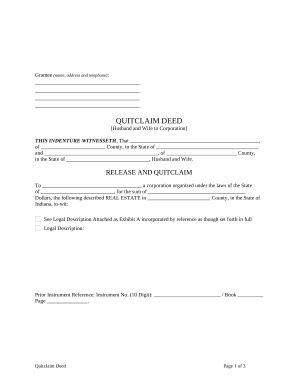

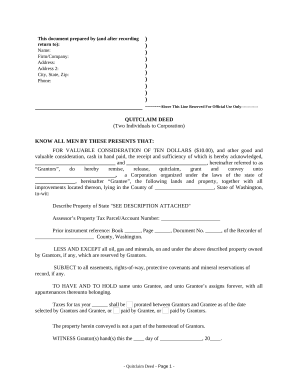

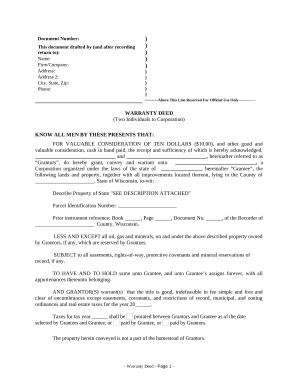

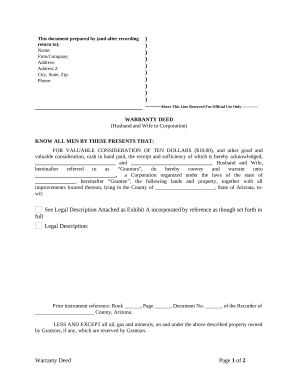

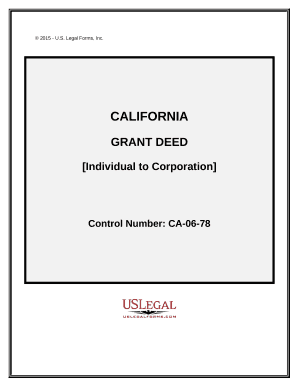

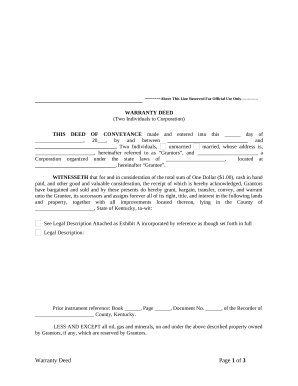

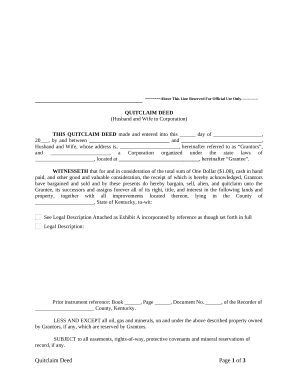

Your workflows always benefit when you are able to discover all of the forms and files you need on hand. DocHub gives a huge selection of form templates to ease your daily pains. Get a hold of Transfer Property to Corporation category and quickly find your form.

Start working with Transfer Property to Corporation in a few clicks:

Enjoy smooth document managing with DocHub. Discover our Transfer Property to Corporation collection and locate your form right now!