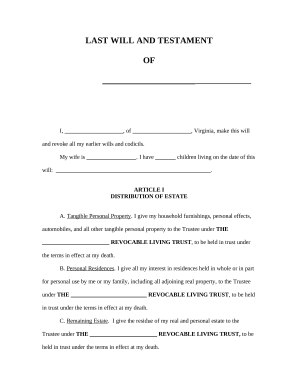

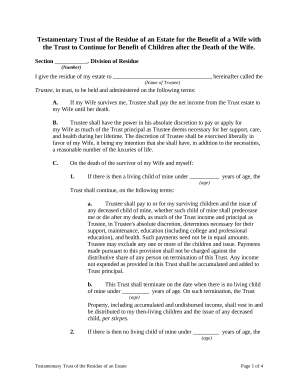

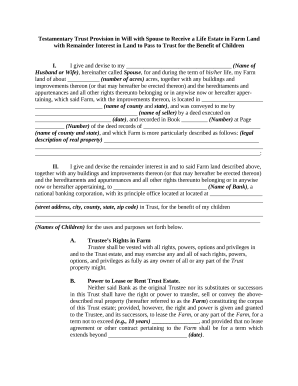

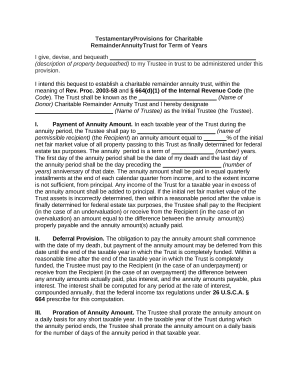

Your workflows always benefit when you are able to locate all of the forms and documents you may need at your fingertips. DocHub delivers a wide array of documents to relieve your everyday pains. Get hold of Testamentary Trusts category and quickly find your document.

Begin working with Testamentary Trusts in several clicks:

Enjoy smooth form administration with DocHub. Check out our Testamentary Trusts collection and look for your form today!