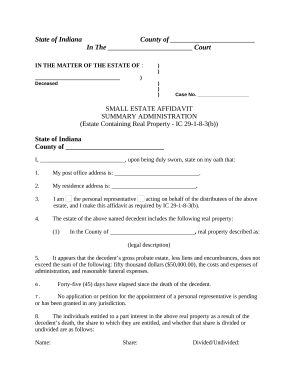

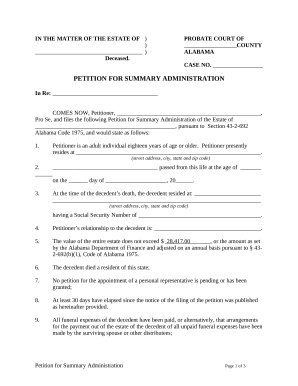

Boost your form operations using our Small Estates Forms library with ready-made templates that meet your requirements. Get the form template, edit it, fill it, and share it with your contributors without breaking a sweat. Begin working more efficiently with the documents.

How to use our Small Estates Forms:

Discover all of the possibilities for your online file management with the Small Estates Forms. Get your totally free DocHub account right now!