Your workflows always benefit when you can find all of the forms and documents you will need on hand. DocHub gives a a huge collection of documents to relieve your day-to-day pains. Get hold of Single Person Will category and quickly find your form.

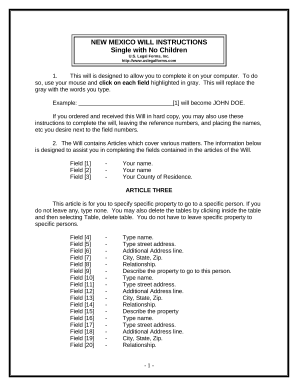

Begin working with Single Person Will in several clicks:

Enjoy fast and easy form managing with DocHub. Discover our Single Person Will collection and look for your form today!