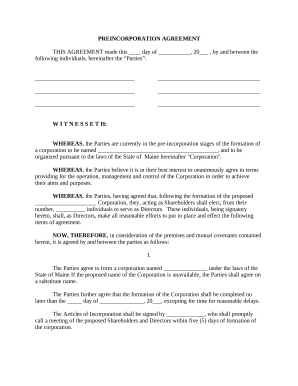

Boost your file administration using our Shareholders Agreements online library with ready-made templates that meet your needs. Get your document, change it, complete it, and share it with your contributors without breaking a sweat. Start working more efficiently with the documents.

The best way to manage our Shareholders Agreements:

Explore all the possibilities for your online document administration using our Shareholders Agreements. Get a totally free DocHub account right now!