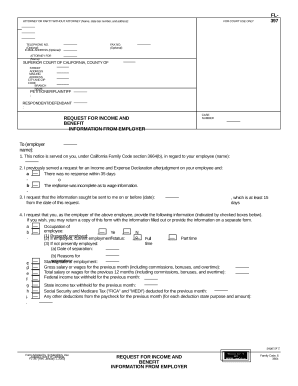

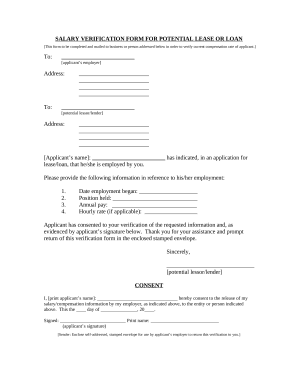

Your workflows always benefit when you can easily get all the forms and documents you may need at your fingertips. DocHub provides a a huge collection of form templates to ease your day-to-day pains. Get a hold of Salary Verification Forms category and easily discover your document.

Start working with Salary Verification Forms in several clicks:

Enjoy easy form administration with DocHub. Explore our Salary Verification Forms online library and look for your form right now!